Egypt’s non-oil private sector contracted for a sixth straight month in August, as weak demand continued to weigh on output and new orders, though businesses saw some relief from softer cost pressures, a survey showed on Wednesday.

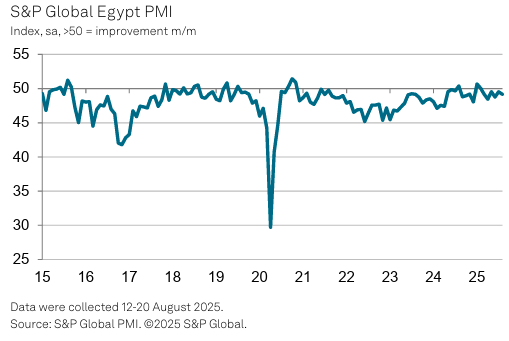

The S&P Global Egypt Purchasing Managers’ Index (PMI) slipped to 49.2 in August from 49.5 in July, staying below the 50.0 threshold that separates growth from contraction. The latest reading pointed to a faster decline in business conditions, though less severe than the survey’s long-run average.

Firms reported a further fall in output and new orders, which they linked to subdued customer demand and concerns about persistent inflation. Input purchases and inventories also declined, contributing to quicker supplier delivery times.

Despite the downturn, employment rose for the second month in a row after nine months of stagnation. The rate of job creation, however, was marginal.

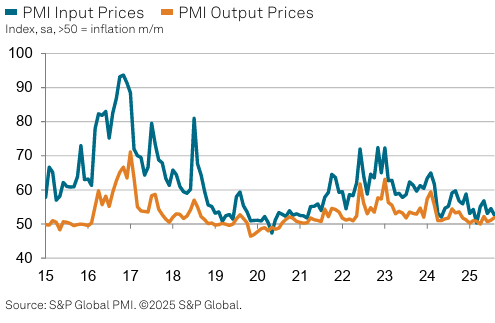

Cost pressures eased notably, with input price inflation slowing to a five-month low, marking “one of the least pronounced increases in the past four-and-a-half years.” Companies nevertheless raised their selling prices at the fastest pace since May, helping narrow the squeeze on profit margins.

“Persistent inflationary pressures appear to be a key factor holding back company sales and output projections,” said David Owen, senior economist at S&P Global Market Intelligence. “However, the latest PMI data signalled that business cost pressures were at one of their lowest levels since early 2021. If this can be sustained and passed onto customers in the form of lower prices, firms could see client appetite stage a recovery.”

Attribution: Amwal Al Ghad English

Subediting: Y.Yasser