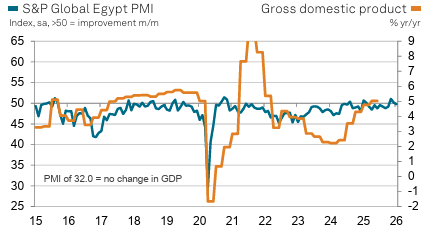

Egypt’s non-oil private sector continued to expand in January 2026, with output rising for the third consecutive month, marking the longest streak of growth since late 2020. The seasonally adjusted headline PMI dipped slightly from 50.2 in December to 49.8 in January, signalling a marginal weakening in operating conditions.

Overall momentum eased amid softer demand, as companies focused on clearing backlogs, reducing employment, and lowering charges for the first time in over five years.

Declines in new orders and employment offset gains in business activity and stocks of purchases, while supplier delivery times improved slightly. Despite the dip, the PMI remained above its long-term average, reflecting robust non-oil GDP growth.

Firms noted that the rise in output was partly driven by stronger overseas demand. However, overall sales fell slightly following two months of expansion, allowing companies to fulfil outstanding orders. This contributed to the fastest reduction in work backlogs in nearly three years. Several businesses left positions unfilled, resulting in the largest decline in employment since October 2023.

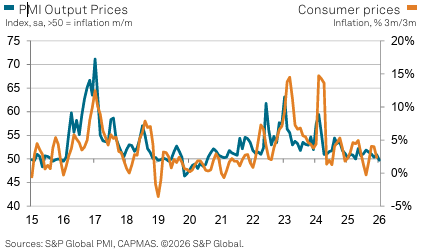

Cost pressures eased further, with input prices and staff costs rising at the slowest pace in ten months. This allowed companies to reduce selling prices for the first time since July 2020.

S&P Global highlighted that non-oil firms adopted a cautious approach to purchases. While overall input quantities fell modestly, stock volumes increased for the first time since September 2025, supported by prior orders and weaker demand.

Looking ahead, Egyptian non-oil companies remained cautiously optimistic about activity over the next 12 months, with expectations only marginally positive.

Attribution: Amwal Al Ghad English