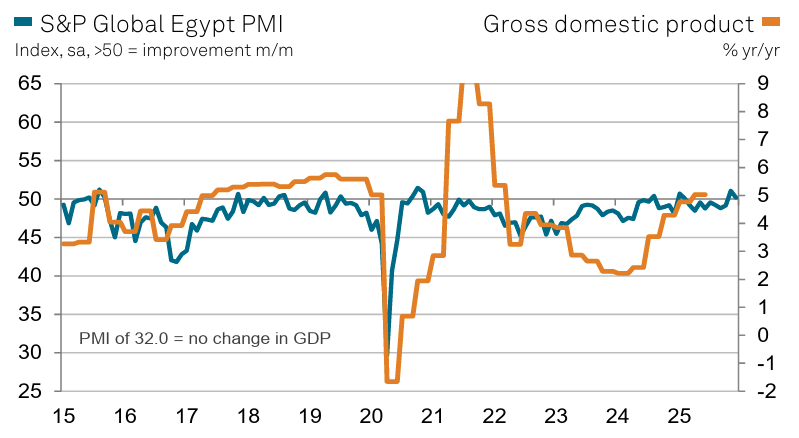

Egypt posted a 50.2 reading in December 2025 on the headline seasonally adjusted S&P Global Egypt Purchasing Managers’ Index, keeping the non-oil private sector just inside growth territory for the second month running, after November reached a high of 51.1.

The Egypt PMI signalled back-to-back improvements in business conditions at the end of the year, only the second such occurrence in more than five years, as firms reported output increases for the second month in a row and continued to receive higher new orders.

“Egyptian businesses have seen things improve at the end of 2025. December’s PMI signalled another upturn in operating conditions across the non-oil sector which, when combined with October and November’s figures, represents the best quarterly performance since the final quarter of 2020.” David Owen, senior economist at S&P Global Market Intelligence, said.

Demand conditions strengthened with greater client spending, although the pace of expansion in both activity and inflows of new work slowed compared to November.

Purchasing activity rose for the first time since last February, marking the first increase in ten months, and companies lifted their purchases of inputs accordingly.

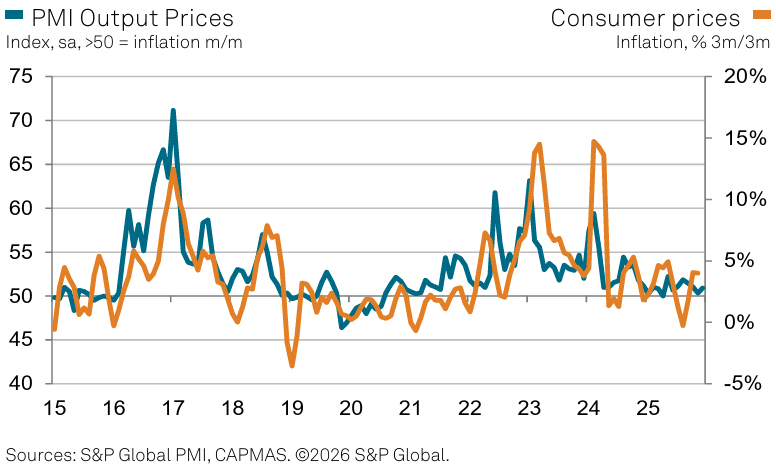

“Improvements in order books have been a clear factor behind strong business performances over the past few months. The uplift in sales arrived amid a softening of inflationary pressures in the Egyptian economy, which has enabled businesses and consumers to spend with more confidence.” Owen added.

“Adding to signs of growth spreading, firms’ purchases of inputs increased for the first time in ten months.”

The composite index historically correlates with annual gross domestic product growth of approximately 5 per cent, well above the 32.0 level that is consistent with no change in GDP.

Manufacturing and construction sectors experienced growth in output, while wholesale and retail and services recorded declines. Input cost inflation remained subdued overall but edged up slightly from November low, with increases noted in fuel, cement and wages, resulting in only a marginal rise in average selling prices.

Employment fell despite the upturn in demand, reflecting hiring caution and difficulties replacing staff who had left, and the drop was the sharpest in 13 months, though still modest.

Stocks of purchases decreased for the third month in succession as some firms cited vendor shortages.

Attribution: Amwal Al Ghad English

Subediting: Y.Yasser