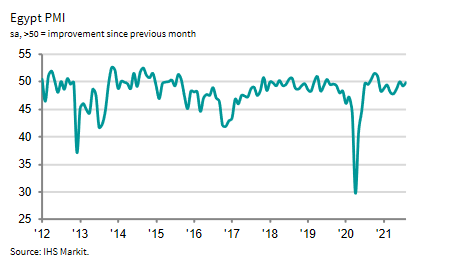

Egypt’s non-oil private sector narrowed for a ninth month in a row in August, but its Purchasing Managers’ Index (PMI) inched closer to growth, a survey showed on Sunday.

Local firms rapidly expanded their purchasing, output, and employment on increased demand during August.

IHS Markit’s PMI jumped to 49.8 – just below the 50.0 threshold that separates growth from contraction – compared with 49.1 in July.

“Purchasing activity expanded for the first time in nine months and at the quickest pace since the series began in April 2011,” IHS Markit said in its latest survey.

Egyptian firms worked on building their input stocks in August “amid fears that rising new orders and supply-side pressures would lead to further price increases.”

The subindex for the quantity of purchases climbed to 54.9 from 47.6 in July, while the purchase costs subindex surged to 58.7 from 54.1.

According to IHS Markit, input price increases accelerated to their fastest in two years, a development firms linked mainly to a pandemic-related tightening of the international prices of commodities such as metals, timber, and plastics.

This and higher demand have sparked fears of further price surges, IHS Markit further noted.

The new orders subindex expanded to 50.4 compared to 48.7, marking its quickest since November.

“Firms seeing an improvement in demand attributed this to a revival in market activity and rising tourist numbers following the pandemic,” IHS Markit economist David Owen said in the survey.

“August saw Egyptian non-oil output and new orders creep upwards for just the second time in nine months, following a renewed upturn in June. In addition, both of these indices posted above their long-run averages for the fourth month in a row, and gave further indication that the economy is on a second phase of recovery from the pandemic after an initial rebound towards the end of 2020.”

“However, PMI data also showed the widespread risk of inflation, as input prices picked up at the fastest rate since August 2019. Selling prices were raised to the greatest extent in three years, while firms also sought to create buffer stocks amid fears that costs will continue to increase. Consequently, purchasing activity rose at the strongest rate on record, although global supplier delays meant that firms are yet to see many of these inputs arrive.” Owen added.