French inflation fell more than anticipated in January, hitting the lowest point since before the Russian invasion of Ukraine, Bloomberg reported on Wednesday.

This indicates that the Eurozone’s attempts to control rising prices are almost over.

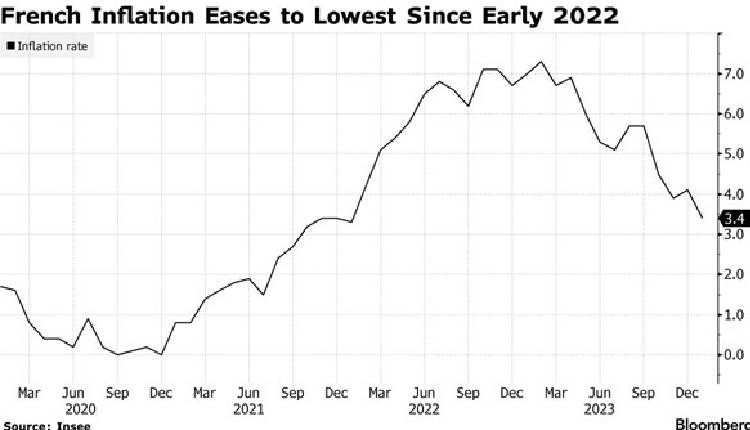

The inflation rate for the second-largest economy in the euro bloc was 3.4 per cent year-on-year, down from 4.1 per cent in December.

This is lower than the 3.6 per cent median forecast in a Bloomberg survey and significantly below the peak of 7.3 per cent recorded in February 2023.

The two-year low in inflation resulted from reduced costs of energy, food, and manufactured products, as reported by the statistics agency Insee.

Data from Germany on Wednesday and from the Eurozone on Thursday is expected to reflect a similar trend.

This has led investors to speculate that the European Central Bank will start reducing interest rates in April.

Following the release of the French data, European bonds saw increased gains and the euro declined.

The 10-year yield on German debt fell up to seven basis points to 2.20 per cent, and the euro decreased by 0.4 per cent, reaching the day’s low at $1.0807.

Policymakers, including the President of the European Central Bank, Christine Lagarde, have shown caution towards easing measures, indicating that summer could be a more probable time to start.

However, Bank of France Governor Francois Villeroy de Galhau stated over the weekend that they would base their decisions on incoming data, and they haven’t ruled out any dates for the initial reduction.

When deciding on the next steps, a crucial consideration will be the indicators of core inflation, which exclude fluctuating components like food and energy.

Although the initial figures from France don’t include this measure, they indicate a slight increase in the cost of services in January.