French inflation slowed to its lowest point since September 2021, intensifying discussions about the timing of the European Central Bank’s (ECB) interest rate cut actions, Bloomberg reported on Thursday.

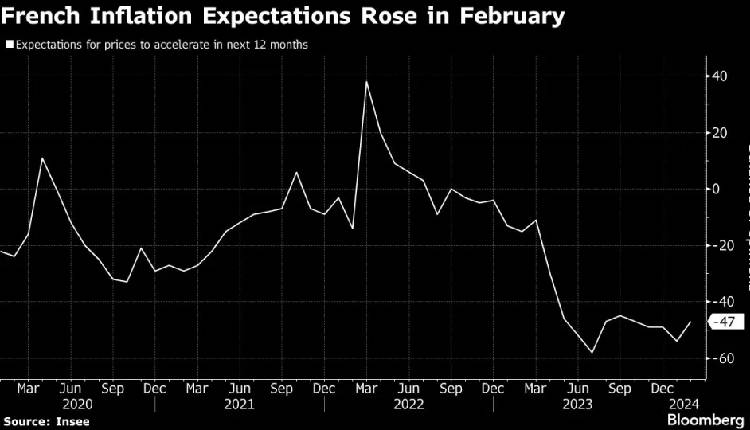

In February, consumer prices in the second-largest economy of the euro area increased by 3.1 per cent compared to the previous year, a decrease from 3.4 per cent in the prior month, aligning with a Bloomberg economists’ survey.

Additionally, separate data revealed a slowdown in Spain’s inflation to 2.9 per cent from 3.5 per cent, slightly exceeding expectations.

Germany is anticipated to report a reduced inflation figure later on Thursday, followed by Eurostat’s release of data for the entire 20-member euro zone on Friday, where a decrease in inflation to 2.5 per cent from 2.8 per cent is expected by analysts.

As energy prices fall and Europe’s economy remains stagnant, there is a general shift towards the ECB’s 2 per cent target.

However, officials in Frankfurt are warning against prematurely easing monetary policy due to concerns about potential inflation.

The euro remained stable at approximately $1.08, causing little shift in market expectations regarding the extent and speed of ECB rate reductions this year. Market participants anticipate these cuts to commence in June and are factoring in just below a one percentage point decrease by December.

In a distinct report from Insee, it was revealed that consumer spending decreased by 0.3 per cent in January, with expenditures on manufactured goods falling by 1.5 per cent. This surpassed economists’ predictions of a 0.2 per cent decline.

In a bit of positive news, Insee adjusted its fourth-quarter GDP reading for last year upward to 0.1 percent, a slight improvement from the previously reported stagnation.