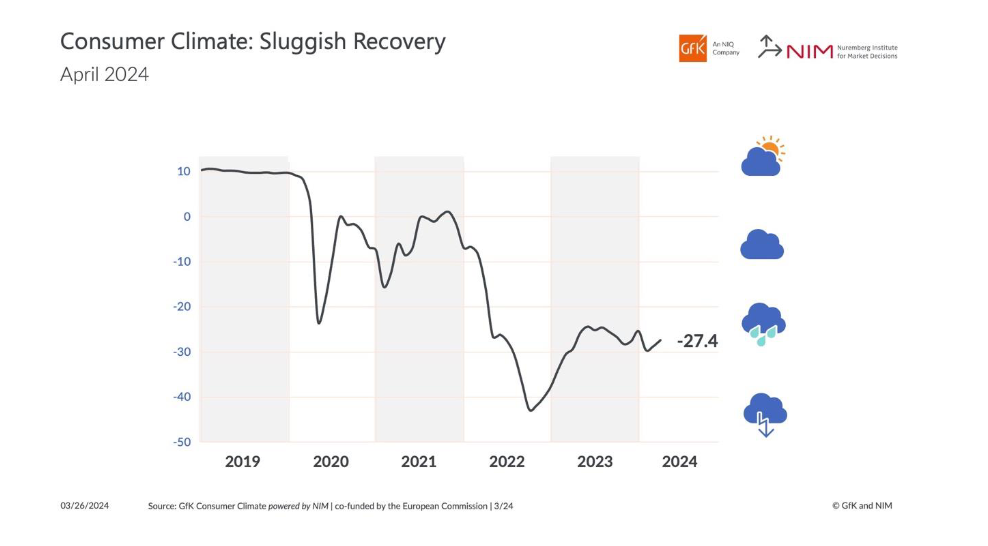

German consumer sentiment is expected to remain on its way for slow recovery in April, according to a recent survey.

The consumer sentiment index released jointly by GfK and the Nuremberg Institute for Market Decisions (NIM) rose slightly heading into April, to -27.4 from a revised -28.8 in March, exceeding expectations made by by analysts polled by Reuters of -27.8.

This improvement is partly due to a decrease in the propensity to save, which dropped five points to 12.4, although it remains high compared to last year’s 1.3.

Rolf Buerkl, a consumer expert at NIM, noted that the recovery is sluggish, with real income growth and a stable job market not enough to instill consumer confidence and optimism for the future.

“The recovery in the consumer climate is slow and very sluggish,” Rolf Bürkl, consumer expert at NIM, explained.

“Real income growth and a stable job market themselves provide good conditions for rapid improvement in consumer sentiment, but there’s still a lack of planning security and optimism about the future among consumers. In times of multiple crises, the high degree of consumer uncertainty, paired with low confidence in Germany’s economic development, is holding back the willingness to buy. As a result, domestic demand is still failing to stimulate the economy. In a nutshell: The poor sentiment is overshadowing the facts.”

The institutes suggest that reduced inflation and a definitive political strategy for Germany’s development are essential for consumers to feel secure in their financial planning and to support the rebound of Europe’s largest economy.

“A sustained recovery of the German economy is therefore not yet in sight. Above all, this would require a reduction in the high level of uncertainty among the population. But for that to happen, inflation has to come down in Germany and there needs to be a clear political strategy for developing the country in the years to come. This is the only way for consumers to regain more planning security, which is an important prerequisite for investing in larger purchases.” the survey read

The consumer climate indicator, which predicts real private consumption trends, shows that a reading above zero indicates growth, while below zero suggests a decline from the previous year.

GfK states that a one-point shift in the indicator reflects a 0.1 per cent year-on-year change in private consumption.

The “willingness to buy” metric gauges consumer readiness to make significant purchases, while the income expectations sub-index and the business cycle expectations index measure projections for household finances and the general economic outlook over the next year.