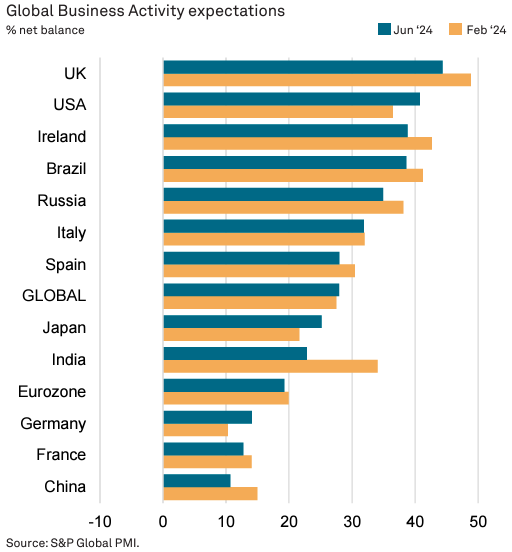

Global business sentiment has remained stable, according to the S&P Global Business Outlook Survey. The survey, which included responses from 12,000 companies, shows a net balance of +28 per cent of companies expecting an increase in business activity, unchanged from earlier in the year.

This stability reflects a mix of regional trends, with rising optimism in the US and Japan counterbalancing a decline in confidence in BRIC emerging markets. Moreover, European sentiment remains steady, with notable improvements in Germany.

Sector-wise, service providers remain more optimistic than manufacturers, maintaining a pattern observed earlier in the year. Despite expectations for modest increases in employment and investment, inflationary pressures are anticipated to remain high. Non-staff and staff cost pressures have not eased, with the latter slightly higher than at the beginning of the year.

Capital expenditure (capex) plans have improved, with a net balance of +10 per cent of companies expecting to increase capex, up from +8 per cent in February. This marks the highest level in a year, with capex plans revised upward in the Euro area, the UK, US, and Japan, while emerging markets saw a slight decline.

Employment expectations remain stable, with service providers more likely to forecast job growth than manufacturers. Hiring intentions have picked up marginally in the Eurozone but remain unchanged in the US and Japan, and have dipped slightly in the UK.

The survey indicates a cautious yet stable global business outlook, with persistent inflationary challenges and mixed regional prospects shaping corporate sentiment for the coming year.

Attribution: S&P Global Business Outlook Survey