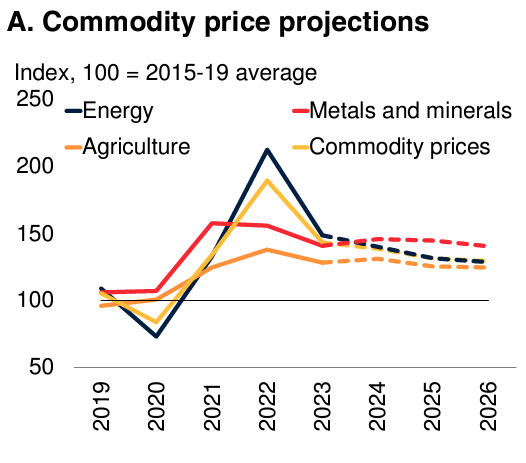

The World Bank said on Wednesday the commodity price index is expected to decrease by 3 per cent in 2024, followed by further retreats of 5 per cent in 2025 and 2 per cent in 2026, as per its latest Commodity Markets Outlook.

This decline will bring aggregate commodity prices to their lowest level since 2020, remaining nearly 30 per cent above the 2015-2019 average. While individual commodity price projections vary, the overall decline is largely attributed to improving supply conditions and moderate global economic growth.

Energy Prices

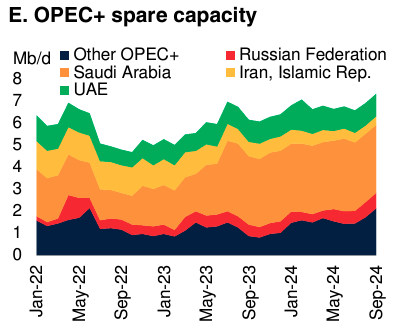

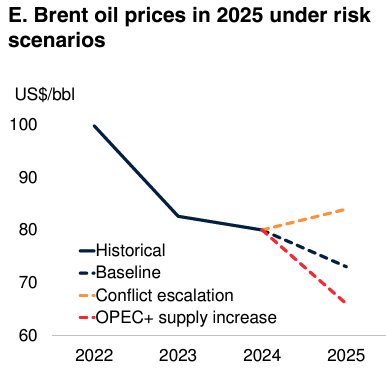

The energy price index is anticipated to fall by 6 per cent in 2024, with similar declines of 6 per cent in 2025 and 2 per cent in 2026. This forecast assumes stability in global economic growth and an increase in oil supply from non-OPEC+ producers, alongside OPEC+ countries maintaining spare capacity and delaying supply cuts.

Brent crude oil prices are projected to average $80 per barrel in 2024, declining to $73 per barrel in 2025 and $72 per barrel in 2026. Global oil supply is expected to reach approximately 105 million barrels per day in 2025, primarily driven by increases in Brazil, Canada, Guyana, and the United States.

Metals Prices

The metal price index is expected to drift slightly lower from 2025 to 2026. Base metal prices are forecast to hold steady next year before decreasing by 3 per cent in 2026, reflecting moderate industrial growth, particularly in China.

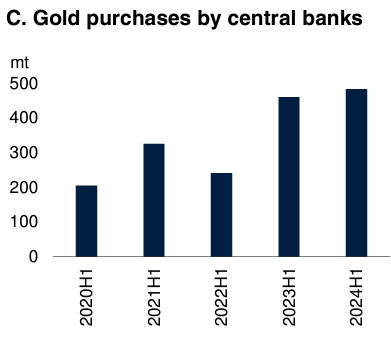

Following a 10 per cent drop this year, iron ore prices are anticipated to decline further as major producers expand output. In contrast, the precious metals price index, bolstered by strong demand and geopolitical tensions, is expected to plateau at record levels.

Agricultural Prices

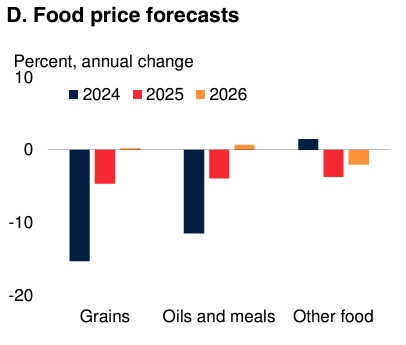

After a slight increase in 2024, agricultural prices are projected to fall by 4 per cent in 2025 due to rising supplies and favorable weather conditions. Food commodity prices, including grains and oils, are expected to decline by 9 per cent in 2024, followed by a further 4 per cent drop in 2025.

While beverage prices are forecast to partially decline after a 58 per cent surge, agricultural raw material prices are likely to remain stable over the forecast period. This overall trend is anticipated to improve food affordability, particularly in emerging markets.

Attribution: World Bank Commodity Markets Outlook

Subediting: Y.Yasser