Global oil demand rose by 870,000 barrels per day (kb/d) in the second quarter of 2024, according to the International Energy Agency’s (IEA) Monthly Oil report released on Tuesday. However, this growth was tempered by a decline in Chinese consumption. Looking ahead, demand is expected to increase by less than 1 million barrels per day (mb/d) in both 2024 and 2025, marking a significant slowdown from last year’s 2.1 mb/d growth due to weaker macroeconomic drivers.

Supply Dynamics

World oil supply increased by 230 kb/d to 103.4 million barrels per day (mb/d) in July. This rise was primarily due to a notable increase from OPEC+ that offsets losses from non-OPEC+ producers. The supply is projected to grow by 730 kb/d in 2024 and 1.9 mb/d in 2025. While non-OPEC+ production is set to rise by 1.5 mb/d this year and next, OPEC+ output may fall by 760 kb/d in 2024 but could increase by 400 kb/d in 2025 if voluntary cuts remain in place.

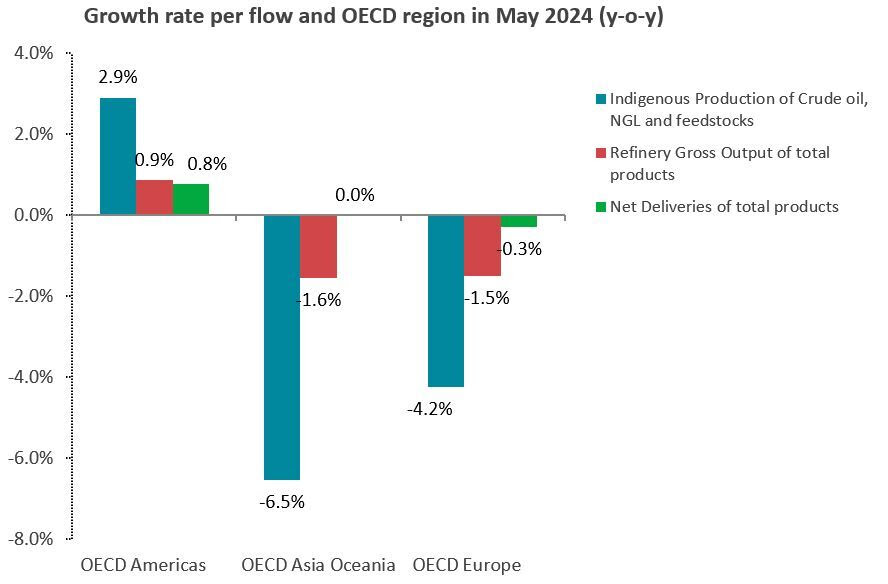

Refinery Throughput and Margins

Refinery throughput is forecast to increase by 840 kb/d to 83.3 mb/d in 2024 and by 600 kb/d to 83.9 mb/d in 2025. Nonetheless, margin weakness continues to impact processing rates, with a decline in Chinese refinery anticipated. Margins fell in Europe in July but rose in Singapore and the US Gulf Coast, driven by stronger naphtha and gasoline cracks.

Inventory Changes

Global oil inventories fell by 26.2 million barrels (mb) in June after four months of increases totaling 157.5 mb. OECD onshore stocks decreased by 19.5 mb, which was counterbalanced by a 17.5 mb increase in non-OECD countries. Oil on water also declined for the third consecutive month, by 24.2 mb. Additionally, OECD industry inventories were down by 21 mb, aligning with seasonal norms.

Price Movements

Brent crude futures dropped by $6 per barrel (bbl) in July. This decline was influenced by weak economic data and a risk-off sentiment despite escalating Middle East tensions. As of early August, Brent was trading around $80/bbl. Market volatility persisted, with geopolitical tensions and mixed macroeconomic data causing fluctuations in oil prices.

Outlook

The IEA report underscores that the global oil market is currently experiencing a supply deficit due to strong peak summer demand, which has led to inventory declines. Following four months of inventory increases, June saw a 26.2 mb reduction in oil stocks. This trend of falling inventories and robust demand is affecting refinery margins and may lead to shifts in refinery activities in the coming months.

Attribution: International Energy Agency’s (IEA) Monthly Oil report August

Subediting: M. S. Salama