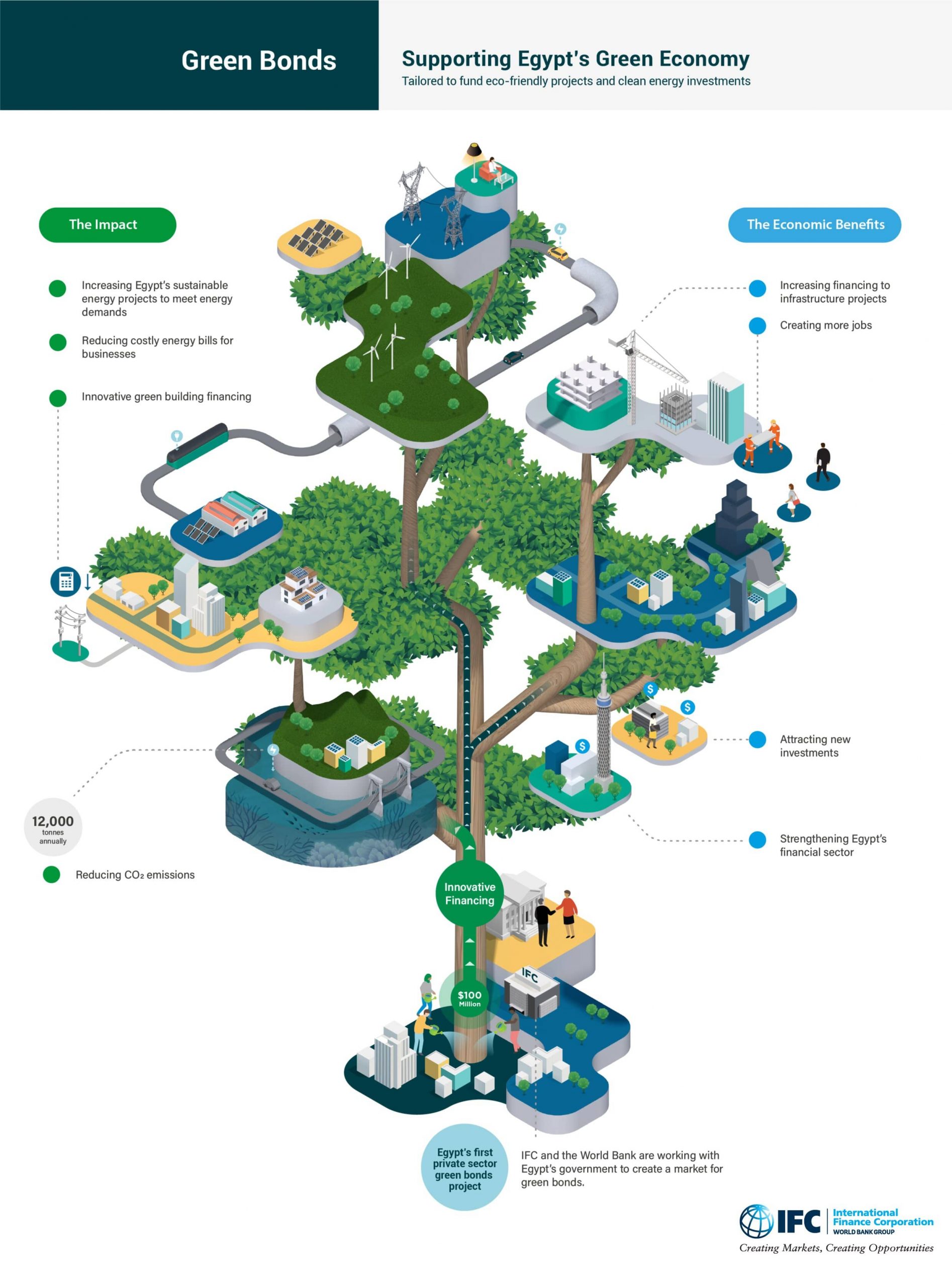

IFC invests $100 million in Egypt’s first private sector green bond

The International Finance Corporation (IFC), a World Bank member, announced on Tuesday it is investing $100 million in Egypt’s first private sector green bond, issued by the Commercial International Bank (CIB) in June.

The bond will help CIB increase lending to businesses that want to invest in eco-friendly initiatives, including green buildings, renewable energy and energy efficiency, markets which are still nascent in Egypt.

IFC said that the debut issuance is an important milestone in a multi-year effort by the Egyptian government, private sector, and IFC to grow Egypt’s capital market for green finance in the country and to help close infrastructure financing gaps.

“Egypt is taking strides towards the achievement of its 2030 development agenda, which is in line with the global sustainability goals. In 2020, the government of Egypt launched its first sovereign green bond offering, that was five times oversubscribed.” Egypt’s Minister of International Cooperation Rania al-Mashat said.

“At the Ministry of International Cooperation, we aim to capitalise on this success by curating impactful partnerships to push towards the green recovery,”

The partnership between the IFC and CIB is a proof of the global eagerness for more private-led green investments, al-Mashat said, adding that green bonds “are essential for a purpose-driven economy that pushes towards sustainable projects and encourages investors into not only thinking but as well acting green.”

Egypt’s Financial Regulatory Authority (FRA) realises the importance of promoting sustainable finance as a pathway to the 2030 agenda, the SDGs and the Paris agreement, said Sina Hbous, head of the sustainable development department at FRA.

Hbous added that the FRA have been diligently working to put forward all required regulations and simultaneously working on market development and engaging potential issuers by removing any challenges that might face them.

Meanwhile, Hussein Abaza, CIB’s CEO and managing director said: “We are building on our multi-year strong partnership with IFC to expand our funding options and introduce a new asset class to the Egyptian capital market,”

Addressing climate change is a priority for IFC in Egypt as well as across the MENA, Sérgio Pimenta, IFC’s Vice President for Africa, said.

“With this landmark transaction, we aim to encourage more private sector investment in long-term climate-smart projects, paving the way for job creation, sustainable growth, and a more resilient and green recovery from the COVID-19 pandemic,” Pimenta notedd.

IFC has been one of the earliest issuers of green bonds, through launching its first such issuance in 2010 to help spur the market and unlock investment for private sector projects that support renewable energy and energy efficiency.

Since the launch of its green bond programme in 2010, IFC had issued $10.6 billion across 178 green bonds in 20 currencies.

To date, IFC has supported five financial institutions to issue debut green bonds across Africa.