The authorities in Egypt plan to lengthen debt maturities to reduce rollover risks along with adopting debt reduction strategy, the International Monetary Fund (IMF) report showed on Tuesday.

“With significantly higher financing costs following the outbreak of the war in Ukraine, the authorities have been issuing domestic debt at shorter maturities. But despite challenging market conditions, the authorities remain cognizant of the crucial need to extend the average debt maturity.” the report read.

The authorities recently rolled over about 245 billion Egyptian pounds ($8.85 billion) (2.6 percent of GDP) of 2-year non-marketable debt held by local banks into marketable debt with a maturity of five years.

In addition, they have also started issuing three-year variable rate bonds in an effort to develop debt markets beyond the short end of the curve. To anchor the gradual reduction of gross financing needs, the IMF-supported programme will set an IT on the average maturity of gross local-currency debt issuances to reach 0.97 years by the end of FY2022/23, the report added.

“The issuance maturity is projected to reach around 2 years by the end of the programme. The authorities should continue their efforts to improve debt management with support from IMF technical assistance.”

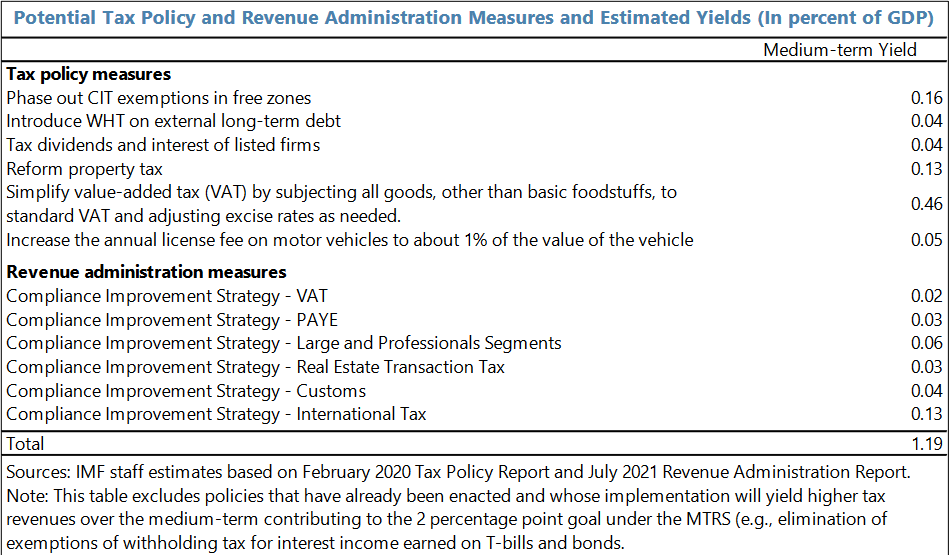

“Domestic revenue mobilisation will support debt reduction and create fiscal space for priority areas. Tax policy and revenue administration measures based on the approved Medium-Term Revenue Strategy will aim to increase tax-to-GDP ratio by around 2 percentage points over the medium term.”

The IMF report also referred to the authorities’ plan to identify tax policy measures that would be implemented in FY2023/24 to ensure an increase of 0.3 p.p. in the tax-to-GDP ratio (end-February 2023 SB).

“To lay the groundwork for streamlining tax exemptions, the Ministry of Finance aims to publish by April 2023 an annual tax expenditure report with details and estimates of tax exemptions and tax breaks, including those provided to companies in free economic zones and all state-owned enterprises (SB).”

“The authorities are also keen to enhance the progressivity of the tax system by advancing property tax reforms through digitalisation (end-August 2023 SB), removal of exemptions, and revision of the valuation model, with plans during the Fund-supported program to reform the income tax to eliminate loopholes and steepen the tax schedule with support from IMF technical assistance (MEFP ¶14).

“These reforms will be complemented by strong efforts on revenue administration, particularly by introducing risk-based enforcement tools.”