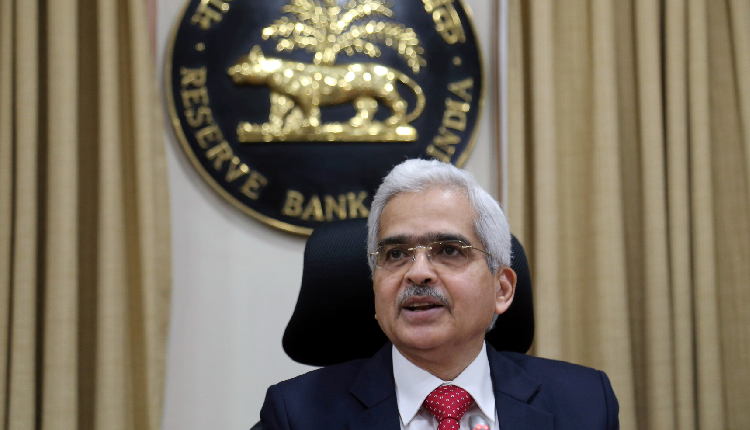

The Reserve Bank of India (RBI) Governor Shaktikanta Das said on Monday that the country would soon launch a Unified Lending Interface (ULI) platform to streamline credit transfer processes for small and rural borrowers.

The ULI aims to address the significant unmet demand for credit in various sectors, particularly agriculture and small businesses.

By digitising the credit appraisal process and facilitating the consent-based flow of information, the platform aims to reduce the time it takes for borrowers to access credit.

The RBI governor emphasised that the ULI is designed to ensure digital access to information from diverse sources, further enhancing its efficiency.

The platform is a part of the central bank’s broader efforts to digitise banking services, which have positioned India as a global leader in digital payments.

Building upon the success of initiatives like digital wallets, mobile banking, and the Unified Payments Interface (UPI), the ULI is expected to play a transformative role in the lending landscape in India.

Das expressed confidence that the ULI will revolutionise the way credit is accessed and disbursed in the country.

Attribution: Reuters

Subediting: Y.Yasser