Shares of Indian brokerage firms plunged on Tuesday following a regulatory directive by the Securities and Exchange Board of India (SEBI).

The new rule mandates market institutions, such as stock exchanges, to levy uniform charges on brokers, regardless of trading volume.

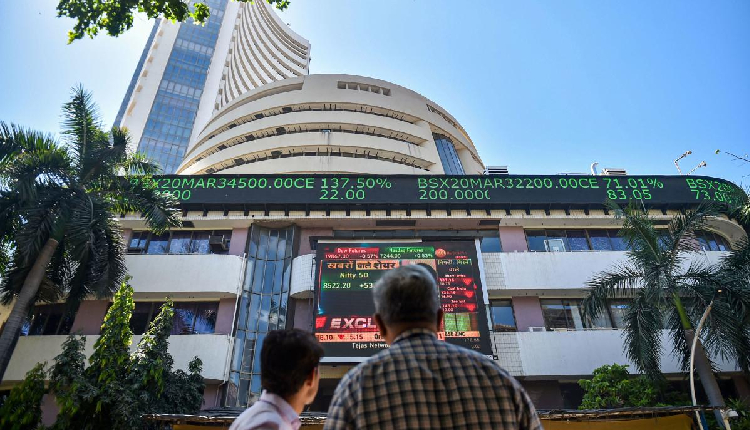

Shares of major brokerages like Angel One, 5Paisa Capital, SMC Global Securities, Motilal Oswal, Geojit Financial, and Dolat Algotech witnessed a decline ranging from three to eight per cent in early trade. The Bombay Stock Exchange (BSE), a leading exchange operator, also faced a 2.5 per cent drop in its stock price.

SEBI’s move aims to curb the surging trend of derivative trading, particularly among retail investors engaging in risky options contracts.

The regulator expressed concerns about these practices last week, prompting discussions on measures to cool down the market.

Tejas Khoday, CEO of discount broker FYERS, highlighted the threat to their business model. He explained that the charges, comprising 15-30 per cent of revenue for large brokers and exceeding 50 per cent for discount brokers, are crucial for their sustainability.

The impact of the regulation comes amidst a period of significant growth for Indian brokerages. Shares of some firms soared between 50-124 per cent this year, fuelled by a surge in trading activity.

Both benchmark indices, Nifty 50 and S&P BSE Sensex, are hovering near record highs. While Dolat Algotech witnessed the highest gain of 124 per cent among brokerage stocks this year, Angel One experienced a 26 per cent decline.

Attribution: Reuters