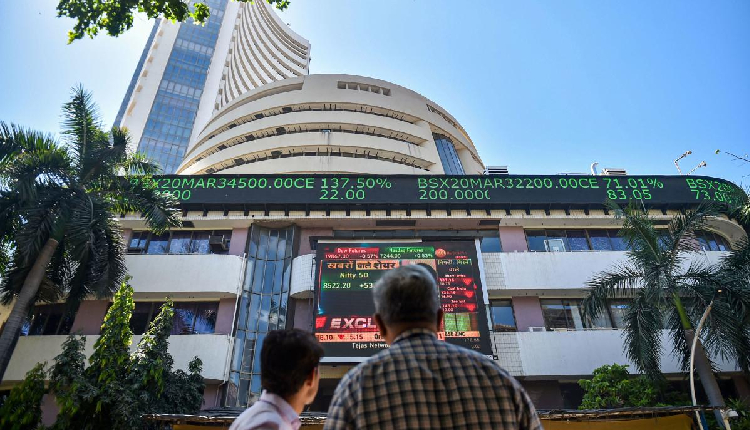

Indian shares fell by about two per cent on Monday, marking their sharpest intra-day decline in two months.

The NSE Nifty 50 index dropped 1.76 per cent to 24,287, while the S&P BSE Sensex fell 1.8 per cent to 79,533.57.

This decline was part of a global sell-off in equities due to concerns about a slowdown in US economic growth.

The US jobs growth data for July showed a more significant slowdown than expected, with non-farm payrolls falling below expectations and the unemployment rate reaching a near three-year high.

“Global markets are reeling under pressure as bears enter with a cocktail of bad news,” said Santosh Meena, head of research at Swastika Investmart.

Meena expressed concerns about a potential slowdown in US growth following the release of dismal jobs data and worries about a reverse yen carry trade, which has negatively impacted market sentiment.

Asian equities also suffered significant losses, with the MSCI Asia ex-Japan index declining 2.9 per cent. Japan’s Nikkei index plunged six per cent to a seven-month low.

Despite the broader market downturn, Indian stocks demonstrated relative resilience compared to their Asian peers. This was attributed to strong domestic economic fundamentals, robust corporate earnings, and ample liquidity.

However, the rupee weakened to a record low, and bond yields fell to a two-year low.

All major stock sub-indexes in India ended in the red, with the realty index leading the decline with a five per cent drop.

Small-cap and mid-cap indices also fell by more than two per cent. Oil & Natural Gas Corp was the top loser on the Nifty 50 index, with shares down 3.7 per cent.

Market volatility increased significantly, and analysts expect it to persist due to the negative global sentiment.

Attribution: Reuters