The upcoming inclusion of Indian sovereign bonds in a key global index could trigger investment outflows from other emerging markets like, Thailand, South Africa, and Poland, according to a report by JPMorgan Chase & Co.

The addition of Indian bonds will join JPMorgan’s Emerging Markets Bond Index (EMBI) this Friday, with their weight set to rise to 10 per cent by March 2025.

This move is expected to attract significant inflows to India, potentially reaching $25 billion. However, there’s a potential downside for some other emerging markets.

JPMorgan strategists, led by Michael Harrison, believe this could be a “zero-sum game” for investors focused solely on emerging markets.

India’s inclusion comes at a time of optimism surrounding its assets. Factors like fiscal consolidation, strong economic growth, and attractive yields make it an appealing investment destination.

Investors tracking the index have already begun to adjust, with 3.6 per cent of their assets allocated to Indian sovereign debt by the end of May, according to Morgan Stanley data.

Foreign investors have already poured over $7.7 billion into India’s bond market so far in 2024, according to Bloomberg data. However, JPMorgan predicts outflows from other emerging markets to make room for India.

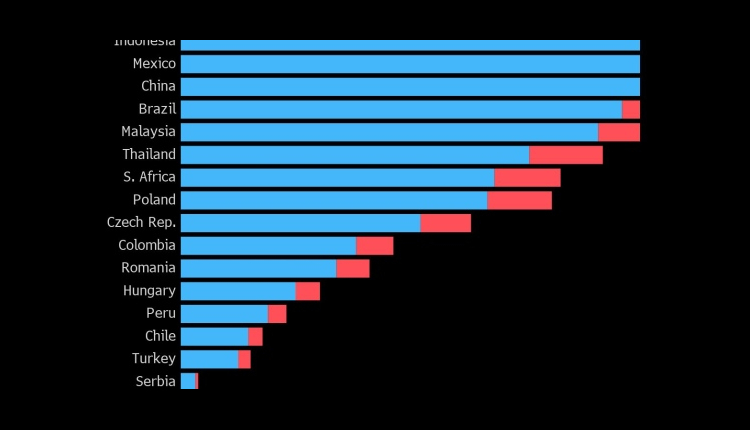

South Africa could see the biggest impact, with potential outflows reaching $4.7 billion after adjusting for current positioning. Poland and Thailand might experience outflows of $3.3 billion and $3.2 billion, respectively.

Attribution: Bloomberg