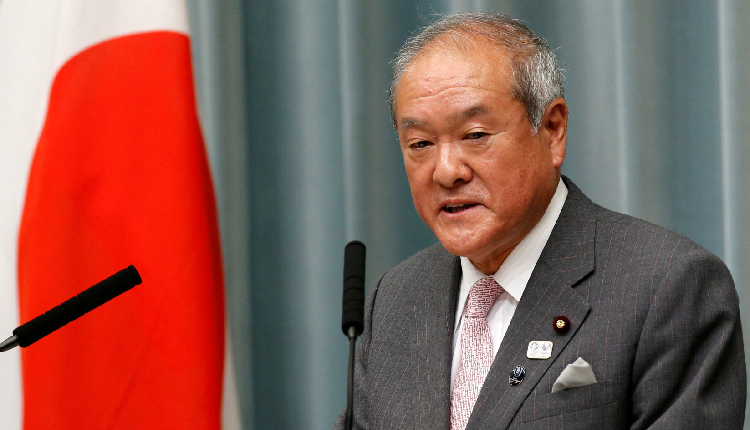

Japanese Finance Minister Shunichi Suzuki expressed concerns about the yen’s weakness and its impact on wage dynamics, Reuters reported on Tuesday. He emphasised the need for a balance between price increases and wage growth.

Suzuki added the goal is to secure wage increases above inflation, despite the challenges posed by high prices.

A weaker yen boosts Japanese exporters’ competitiveness globally but poses challenges for policymakers as it raises costs of imported raw materials, impacting domestic consumption.

The yen’s recent volatility has caught attention. Last month, it dropped below 160 yen per dollar, sparking intervention concerns. It has since recovered, now at around 156.45 yen per dollar.

Suzuki emphasised the need for market-driven foreign exchange rates that reflect underlying fundamentals. Stability is a priority, and the government will closely monitor and intervene in the currency market as necessary.

Suzuki acknowledged the recent surge in Japan’s government bond yields, reaching levels not seen in over a decade. He emphasised the importance of monitoring closely and transparently communicating with traders. The 10-year Japanese Government Bond (JGB) yield is currently around 0.979 per cent in morning trading.

Suzuki reassured the public that the government would implement responsible debt management policies to ensure stable government bond issuance and fiscal stability amid changing economic conditions.