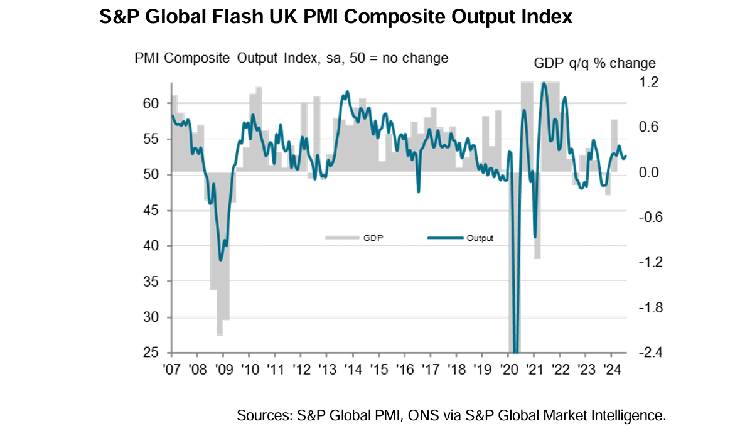

UK private sector activity showed solid expansion in July, with the S&P Global Flash UK PMI Composite Output Index rising to 52.7 from 52.3 in June.

This increase was driven by the sharpest upturn in new business in 15 months and a rebound in business confidence after a dip in June.

Manufacturing output grew at its strongest pace since February 2022, while service activity also accelerated, though still at the softer rates of 2024.

Companies increased staffing numbers at the fastest rate in 13 months, with future activity expectations nearing February’s two-year peak.

Input prices rose at their slowest rate in nearly three-and-a-half years due to easing inflation in services, although manufacturing faced the sharpest cost increase in 18 months due to rising transport expenses linked to the Red Sea crisis.

Output prices rose more slowly, with manufacturing prices increasing at the fastest rate since May 2023.

The report also highlighted a significant rebound in business confidence, with optimism nearing a two-year high, driven by improved demand conditions, anticipated interest rate cuts, and political stability.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, commented on the data, noting that the first post-election survey presents a positive outlook for the new government.

He added that companies in both manufacturing and services are showing increased optimism, reporting a surge in demand and higher staffing levels, while prices have risen at their slowest rate in three and a half years, heightening the likelihood of a summer rate cut.

“Policymakers will likely take a cautious approach to loosening policy amid signs of inflationary pressures pivoting away from services towards manufacturing, where Red Sea shipping delays and higher freight prices are adding to costs again.” Williamson said.

“The renewed hiring trend could also add to pay pressures, sustaining some stickiness of inflation in the coming months.”

Attribution: S&P Global.