Kitco forecasts gold prices to record new highs in 2025

Gold prices soared nearly 30 per cent in 2024, outperforming most assets. Starting the year around $2,000 per ounce, the yellow metal reached a record $2,788.54 on October 30 before consolidating.

Retail and institutional forecasts for 2025 remain bullish, with expectations of breaking $3,000 per ounce.

Spot gold’s rally began in late February, climbing above $2,100 in March and reaching $2,400 by mid-April. After a consolidation phase, the metal breached the $2,400 level in May and steadily climbed to its October peak. November saw a pullback to $2,560 following Donald Trump’s re-election, but renewed inflation fears pushed prices back above $2,700.

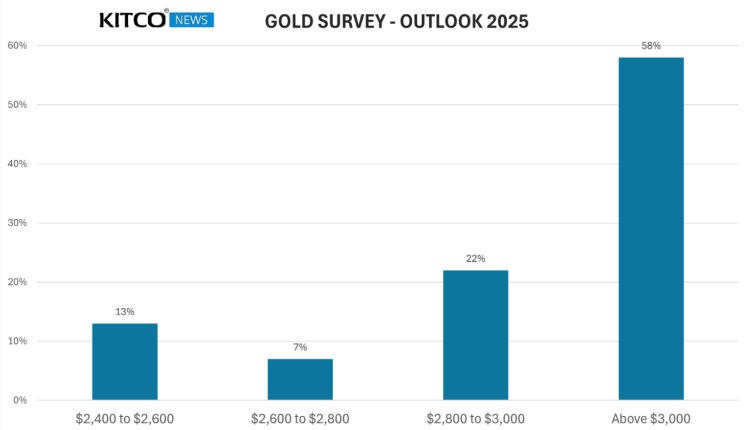

The Kitco News Annual Gold Survey revealed optimism among retail traders, with 58 per cent of participants predicting prices above $3,000 in 2025. Industry experts are more cautious but still expect significant gains. Chantelle Schieven of Capitalight Research forecasts $2,500–$2,700 in early 2025, rising above $3,000 in the second half amid slower economic growth, inflation, and geopolitical risks.

Fawad Razaqzada of City Index warns that higher bond yields and a strong US dollar could challenge gold’s appeal in early 2025. However, he sees potential for prices to surpass $3,000, driven by haven demand and inflationary pressures. ING strategist Ewa Manthey projects an average price of $2,800 in the first half of 2025, supported by sovereign gold buying and geopolitical uncertainties.

BlackRock highlights gold’s role as a hedge against inflation and currency risks. Samara Cohen emphasises diversifying portfolios with assets like gold, given the evolving geopolitical and economic landscape. TD Securities predicts some near-term correction due to profit-taking but expects persistent inflation and instability to sustain gold’s strength.

MKS PAMP’s Nicky Shiels envisions a trading range of $2,500–$3,200 in 2025, depending on Federal Reserve policies and Trump’s economic agenda. Shiels warns of potential diversion to cryptocurrencies but maintains that gold remains a critical portfolio asset.

Gold’s 2024 rally was fuelled by expectations of rate cuts, central bank buying, and geopolitical tensions. While some challenges persist – such as weaker Asian demand and tight monetary policy – analysts agree on gold’s resilience as a store of value. ING and BMO Capital Markets both foresee prices averaging near record highs, with peaks during the summer.

As the global economy navigates inflation, trade wars, and geopolitical fragmentation, gold’s dual role as a safe haven and diversifier ensures its appeal remains strong. Whether prices will break $3,000 per ounce hinges on market dynamics in 2025.

Attribution: Kitco News