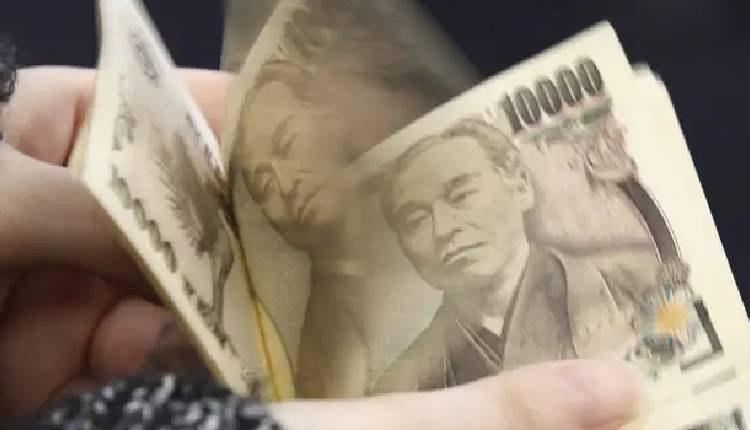

The Japanese yen saw a notable increase against the dollar on Thursday, bolstered by the prospect of further rate hikes from the Bank of Japan and comments from government officials, Reuters reported.

The Australian dollar also experienced a surge following impressive employment data for February, indicating a robust labour market.

The yen’s rise was fueled by a Nikkei report suggesting potential rate hikes in July or October and the Bank of Japan Governor’s indication of a gradual shift towards normalising monetary policy.

The US dollar’s decline, following the Federal Reserve’s decision to maintain its rate cut projections despite inflation surprises, also contributed to the yen’s performance.

The Fed’s stance led to a drop in the greenback, with markets anticipating a 75 per cent chance of a rate cut in June.

The euro and sterling reached one-week highs against the dollar, while the Bank of England is expected to maintain rates, aligning with the slowing British inflation that suggests a future reduction in borrowing costs.

Australia’s employment surge in February, with 116,500 new jobs and a jobless rate fall to 3.7 per cent, boosted the Australian dollar to $0.66295.

The Reserve Bank of Australia, having kept interest rates unchanged, likely welcomed the strong job data. Meanwhile, the New Zealand dollar rose to $0.6097 despite the country entering a technical recession due to a slight economic contraction in the last quarter.