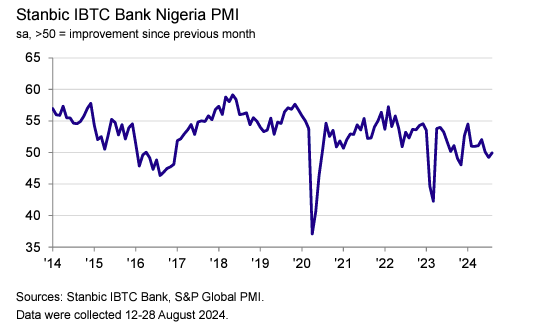

Nigeria’s private sector experienced broadly stable conditions in August, with the Stanbic IBTC Bank Nigeria PMI rising slightly to 49.9 from 49.2 in July. Despite a modest increase in new orders, business activity fell marginally for the second consecutive month.

The PMI reading, just below the neutral 50.0 mark, indicates a stagnation in business conditions. New business saw a slight rebound, reversing the previous month’s decline, though the pace of growth was below the series average.

Growth was noted in three of the four monitored sectors, except for services. Employment increased for the fourth straight month, and firms reduced their backlogs of work at the fastest rate since June 2022.

Input costs continued to rise sharply, with inflation accelerating since July. Companies increased their selling prices accordingly, reaching a five-month high. Rising material and transportation costs, along with currency depreciation, drove up input costs. Firms also scaled back purchasing activity, leading to a reduction in inventories for the first time in 17 months.

Business sentiment for the future remained cautiously optimistic, despite challenges such as high interest rates and currency depreciation. The Nigerian economy grew by 3.19 per cent year-on-year (YoY) in the second quarter of 2024, up from 2.98 per cent in the first quarter, with significant performance from the oil sector. The non-oil sector showed flat growth.

Muyiwa Oni, Head of Equity Research West Africa at Stanbic IBTC Bank, highlighted the stable business environment despite ongoing cost pressures and weak demand. He noted that while inflation is expected to moderate, challenges remain for the non-oil sector and ICT growth. The growth forecast for 2024 remains at 3.1 per cent.

Attribution: Stanbic IBTC Bank Nigeria PMI August

Subediting: Y.Yasser