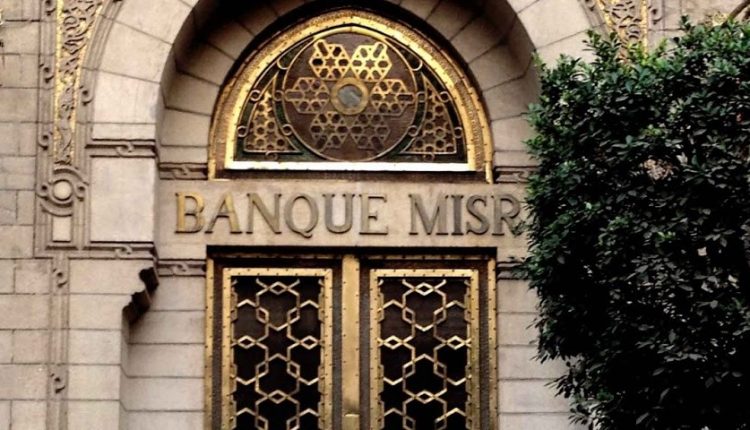

One of Egypt’s oldest lenders prepares to launch its first digital bank in Q1-2022

Banque Misr, Egypt’s second biggest state lender, is expected to launch a digital bank in the homeland within the first quarter of 2022, its vice chairman told reporters on Tuesday.

Akef El Maghraby said the the bank is waiting for the central bank’s approval before releasing its digital bank, whose capital would reach up to 3 billion Egyptian pounds ($191 million).

In late February, Banque Misr announced a partnership with Atos, a French leading firm in digital transformation that will provide the Egyptian bank with technology expertise to support its transformational journey to become the country’s first digital bank.

Atos said at the time that it would deliver a trusted digital banking experience to customers, supporting Banque Misr’s ambition to appeal to a broad demographic, while enhancing its suite of international transactions services.

Banque Misr was established in 1920 by renowned pioneer economist Mohamed Talaat Harb, who came up with the concept of investing national saving and directing them towards economic and social development. Therefore, it became the first bank to be wholly owned by Egyptians. The bank currently owns shares in 162 projects operating in various sectors, including financial, industrial, tourism, housing, agriculture, food, as well as communications and information technology.

Like many other lenders in the Middle East region, Banque Misr is pivoting to digital banking to cater to more segments of clients in line with the Egyptian government’s strategy to foster financial inclusion and create a cashless economy.