Pakistan’s central bank is expected to maintain its key interest rate at a record 22 per cent for the sixth consecutive policy meeting on Monday due to ongoing inflation risks, Reuters reported on Thursday.

However, most analysts anticipate rate cuts starting in the second quarter of this year. This decision on Monday will be the final one before the expiration of a $3 billion Standby Arrangement with the International Monetary Fund (IMF) in April.

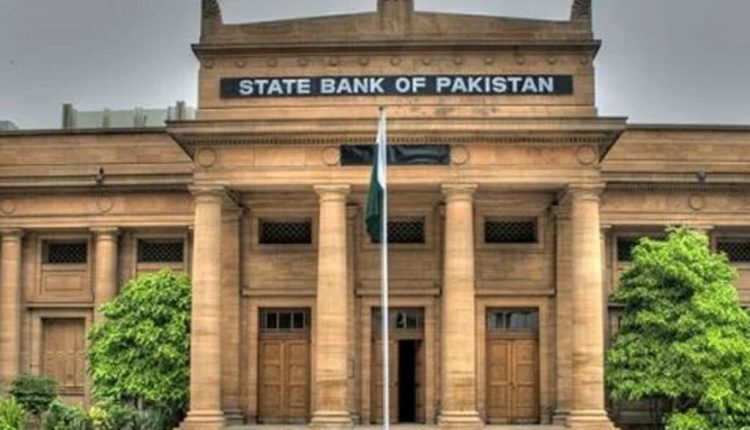

A Reuters poll of 17 analysts forecasts that the State Bank of Pakistan (SBP) will keep rates unchanged.

Three analysts predict a 100-basis-point (bps) cut, while one expects a 25-bps cut. Fourteen analysts anticipate a rate cut in the April-June quarter.

The last increase in Pakistan’s key rate was in June to combat inflation and meet IMF conditions for the bailout.

In February, the country’s consumer price index rose 23.1 per cent year on year, the slowest rate since June 2022, partly due to the “base effect.”

Inflation risks remain high, including the potential sales tax on petroleum products, increased food inflation during Ramadan, and the possibility of entering a new IMF programme, according to deputy head of research at Ismail Iqbal Securities Saad Hanif.

The central bank raised the average inflation forecast for the fiscal year ending in June to 23-25 per cent in January due to rising gas and electricity prices.

Finance Minister Muhammad Aurangzeb expects rates to decrease during the year.

Mustafa Pasha, chief investment officer at Lakson Investments, believes the likelihood of a rate cut is increasing with each policy meeting, expecting a symbolic cut of around 100 bps in Q2 of 2024, with more aggressive moves later in the year.