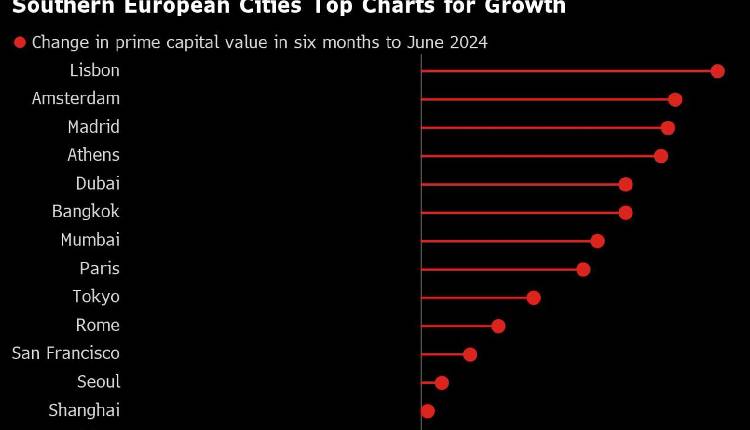

Southern European cities such as Lisbon, Madrid, and Athens saw strong growth in residential property values during the first half of the year, driven by a supply crunch in the high-end housing market.

According to a report by Savills Plc seen by Bloomberg ahead of its official release, Lisbon led with a 4.2 per cent increase in capital values, largely due to wealthy foreign buyers.

Other cities like Amsterdam and Athens also saw growth above 3 per cent, surpassing the 0.8 per cent average increase across the 30 cities tracked by Savills, as reported by Bloomberg News.

High construction costs and development challenges have made Americans a key buyer base in these cities, aided by a strong US dollar. In Dubai, prime real estate values rose as the city attracted wealthy individuals with its low taxes and luxury lifestyle.

Despite economic challenges, confidence in the high-end property market remains robust. However, in the US, high interest rates have slowed the housing market, leading to declines in prime residential prices in three of the four US cities monitored by Savills.

Globally, the prime rental market continues to outpace sales growth. In the Europe, Middle East, and Africa (EMEA) region, no market saw a decline in rental prices between December 2023 and June 2024.

Lisbon, Dubai, and Bangkok saw significant rent increases, with Lisbon experiencing a 7.5 per cent rise. Athens, Barcelona, and other cities reported rental growth exceeding 3 per cent, well above the 2.2 per cent average across the Savills index.

“High interest rates are pushing more buyers into the prime rental markets,” said Kelcie Sellers, associate director at Savills World Research. “We expect rents to continue to outperform capital values through 2024 as supply remains scarce in many world cities.”

Attribution: Bloomberg.