“Courageous” investors looking for long-term opportunities should look to emerging cities in the Middle East, India, and China, according to global real estate advisor Savills.

In its Resilient Cities Index report, Savills highlighted several cities that were still relatively untapped, despite being the most likely to see economic growth amid global disruption in the coming decades.

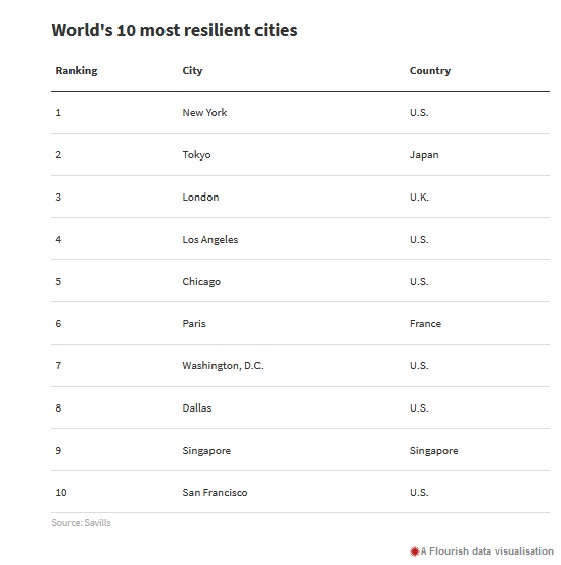

The research analyzed which global hubs would be able to withstand or embrace technological, demographic and political disruption. New York was named the world’s most resilient city, followed by Tokyo, London and Los Angeles.

Savills predicted that the top four cities would retain their positions over the next decade. Shanghai, currently in 11th place, was expected to rise to fifth place by 2028, while London and Paris were the only European cities currently ranked among the 20 most resilient.

The research also highlighted eight “challenger cities” that were forecast to make the top 50 by 2028 by jumping at least 10 places up the index.

Hangzhou, China was the top challenger city, expected to rise from 29th place to 11th in the next decade. Saudi Arabian capital Riyadh was also named among the challenger cities, alongside the Indian cities of Delhi and Mumbai.

The report predicted that within a decade, China will occupy 43 positions in Savills’ Top 100 Resilient Cities ranking. No U.S. or European hubs were given the challenger city status.

Challenger cities were poised to compete with more established locations by using disruption to their advantage, Savills said, adding that they were able to respond faster and more flexibly to swift technological and societal changes.

Speaking to CNBC’s “Street Signs Europe” Wednesday, Sophie Chick, head of world research at Savills, said all eight challenger cities had rising personal wealth, rapid economic growth, and favorable demographics.

“These challenger cities are for those investors looking for a bit of a risk – they’re not established on the world stage, but they present a potential opportunity for long-term investors,” she said. “They are not without risk, but they are there as potential opportunities.”

Savills based its index on gross domestic product (GDP) data, personal wealth, and demographics in each city.

Source: CNBC