Romania’s central bank is facing a tough decision on whether to cut interest rates again amid a global market meltdown and domestic challenges.

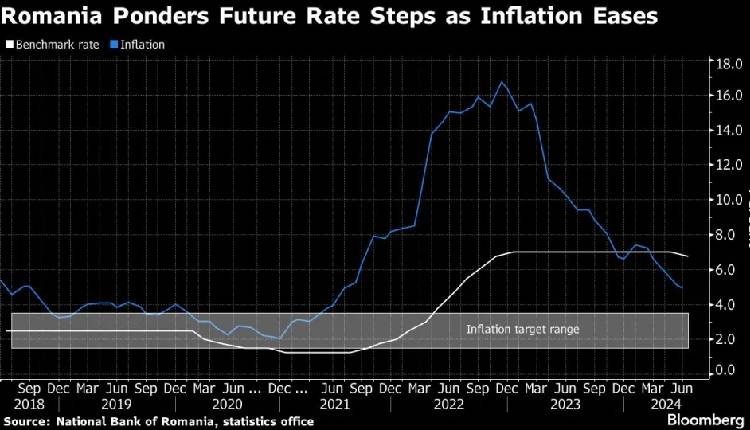

After making its first rate cut in three years in July, the National Bank of Romania is considering another reduction from the current 6.75 per cent, tied for the highest in the European Union (EU).

While 12 out of 20 economists surveyed by Bloomberg expect a pause, others predict a quarter-point cut. The decision is due in Bucharest on Wednesday.

Inflation in Romania has slowed to 4.9 per cent annually as of June, the lowest since 2021, providing some leeway for rate cuts. However, the upcoming elections and a projected budget deficit of up to 7 per cent of GDP pose fiscal risks.

Economist Valentin Tataru of ING Bank notes arguments for both maintaining and reducing rates, with a possible cut expected in November.

Unlike its neighbours, Poland, Hungary, and the Czech Republic, which have been more aggressive in easing monetary policy, Romania must consider potential price pressures if the government raises taxes to meet EU budget commitments.

The central bank will also approve an updated inflation forecast on Wednesday. Tataru suggests that the economic situation requires a data-dependent approach rather than a typical easing cycle.

Attribution: Bloomberg