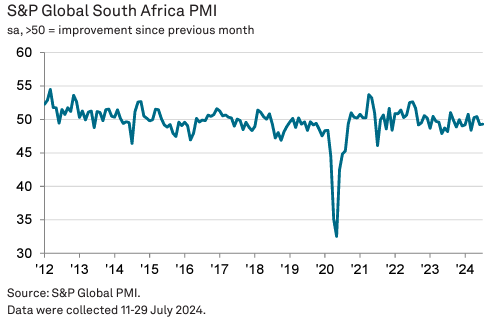

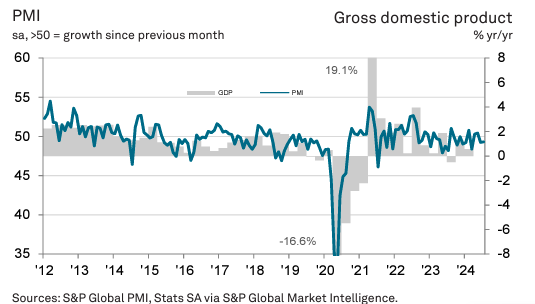

South African businesses experienced a sharper decline in activity in July, with the S&P Global South Africa Purchasing Managers’ Index (PMI) registering at 49.3, slightly below the neutral 50.0 mark. This marked the second consecutive month of contraction, with the downturn in output and new orders being the fastest since March.

Weakening sales and increased supply chain pressures, including domestic and international port congestion, contributed to the decline. Firms reduced purchases and depleted inventories to manage backlogs, leading to lower input stocks and hiring reductions.

Despite these challenges, business confidence reached its highest level since February 2022. Political stability and milder price pressures were cited as positive factors, with input cost inflation remaining subdued and output price rises being the slowest in nearly four years.

David Owen, Senior Economist at S&P Global Market Intelligence, noted that firms were optimistic about future growth due to political stabilisation, reduced load shedding, and softer price pressures. The report further suggested that the Reserve Bank might find encouragement in the easing inflationary pressures.

Attribution: S&P Global South Africa Purchasing Managers’ Index (PMI)