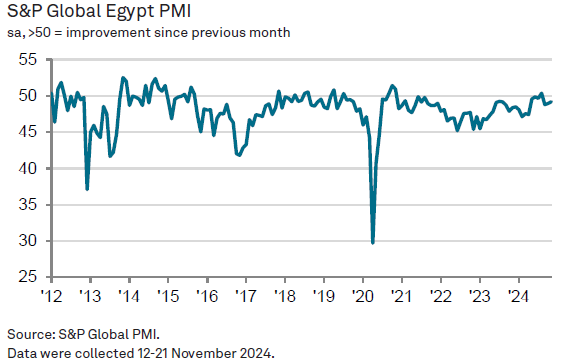

Egypt’s non-oil private sector showed signs of stabilisation in November, as the Purchasing Managers’ Index (PMI) rose to 49.2 from 49.0 in October, marking the least severe contraction in three months, according to S&P Global.

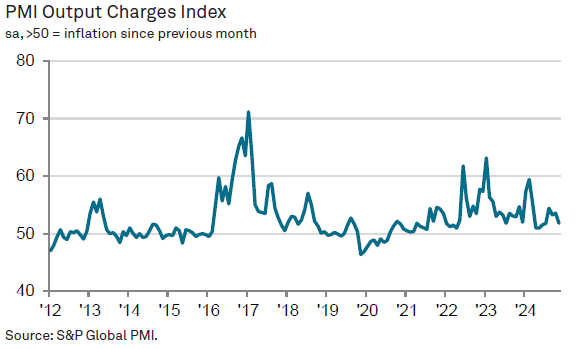

Output and new orders continued to decline, but at a slower pace, with manufacturing showing modest growth that helped offset declines in construction, wholesale and retail, and services. Input costs rose slowly since July, driven by easing wage pressures, though the stronger dollar kept material costs high. Output charges increased modestly, hinting at potential relief for consumer price inflation.

Employment fell for the first time in five months, with staffing cuts linked to weak demand and reduced confidence, marking the fastest decline since February. Future output expectations were near record lows, reflecting continued uncertainty.

David Owen, Senior Economist at S&P Global, noted that while conditions are nearing stabilisation, weak demand in key sectors and subdued sentiment indicate ongoing challenges. The survey thus suggests firms remain cautious about future capacity needs despite easing inflationary pressures.

Attribution: S&P Global Egypt PMI Nov

Subediting: M. S. Salama