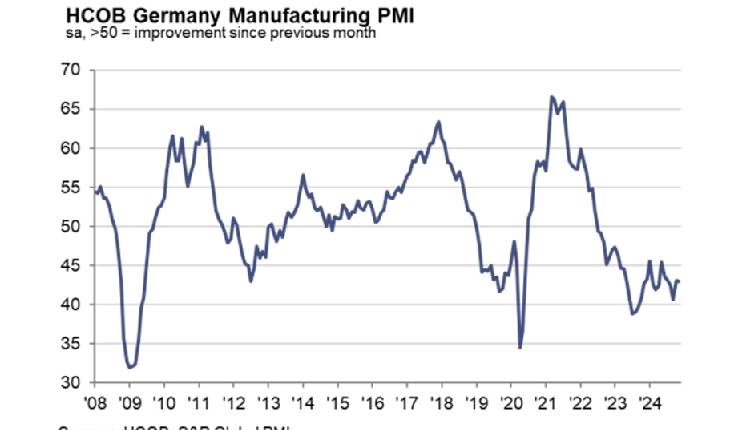

Germany’s manufacturing sector remained in deep contraction in November, with the HCOB Manufacturing PMI holding at 43.0, unchanged from October and well below the 50.0 mark signalling growth.

While the rate of decline in output and new orders slowed for the second month, it was still sharp, impacted by weak demand, geopolitical uncertainties, and a challenging economic climate. Employment cuts continued, marking the second-fastest rate since 2020, with job losses driven by falling order volumes and cost-saving measures.

“The situation for German industry is looking pretty grim. People are feeling the pinch as reports of companies in the manufacturing sector planning massive job cuts are coming in almost daily,” Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said.

Factory production fell at a rate slightly quicker than the average since May 2023, with export sales deteriorating further, especially in the investment goods sector.

The ongoing destocking cycle and cost-saving efforts led to significant reductions in purchasing and inventory levels. Input prices dropped, albeit at a slower pace, while output prices fell sharply, marking the steepest decline since May.

Despite these challenges, business confidence ticked upward, supported by hopes of an economic recovery post-2024 elections. However, sentiment remained subdued, indicating a long road ahead for Germany’s manufacturing sector, which experts predict will continue to face headwinds into the new year.

Attribution: S&P Global

Subediting: M. S. Salama