Egypt’s non-oil private sector continued to shrink in June 2025, with the S&P Global Purchasing Managers’ Index (PMI) declining to 48.8 from 49.5 in May, remaining below the 50.0 threshold for the fourth consecutive month and signalling a modest deterioration in business conditions.

The decline was driven by faster contractions in both output and new orders, with companies citing weak client spending and stagnant local demand. Purchasing activity saw its sharpest drop in 11 months, particularly among manufacturers, prompting a halt in inventory growth after three months of marginal increases.

Employment levels fell for the fifth straight month, though job cuts were minimal. Firms also reported lengthening supplier delivery times for the second month in a row, reflecting mild supply-side pressure.

Business sentiment was notably downbeat, with expectations for future output reaching their lowest level on record. Most firms anticipated no growth, amid concerns about subdued order books and geopolitical risks.

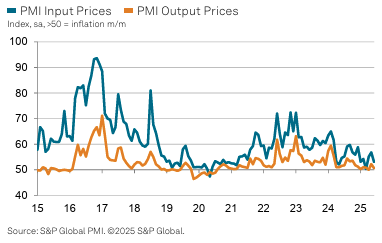

On the inflation front, input costs rose at the softest pace in three months, and output price inflation eased sharply from May’s seven-month high, offering some cost relief for businesses.

Attribution: Amwal Al Ghad English

Subediting: M. S. Salama