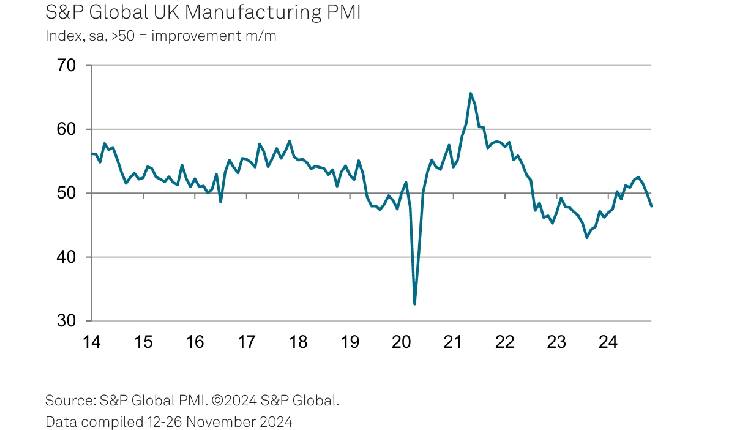

The UK manufacturing sector experienced further contraction in November, with the S&P Global UK Manufacturing PMI dropping to a nine-month low of 48.0, down from 49.9 in October and below expectations.

This marked the second consecutive month below the neutral 50.0 threshold, signalling ongoing challenges. Output declined for the first time in seven months, driven by weaker demand both domestically and overseas.

New order intakes fell sharply, particularly in the intermediate goods sector, indicating significant pressure in the B2B market.

Manufacturers cited delayed investment decisions, geopolitical uncertainties, and rising costs as key factors behind the downturn.

Export conditions remained difficult, with 31 consecutive months of contraction, exacerbated by reduced demand from major markets, including the US, China, the EU, and the Middle East.

The German auto industry’s weakness was notably mentioned as a contributing factor in EU sales.

Small manufacturers were hardest hit, reporting the steepest declines in output and new orders, while medium and large companies faced milder contractions.

Employment in the sector also fell, with job losses accelerating to the fastest rate since February due to cost pressures and low demand.

Despite the current struggles, more than half of manufacturers remain optimistic about production growth over the next year, driven by planned expansions and hopes for economic recovery.

Nonetheless, concerns over geopolitical tensions and rising costs persist, impacting future domestic demand.

Attribution: S&P Global

Subediting: M. S. Salama