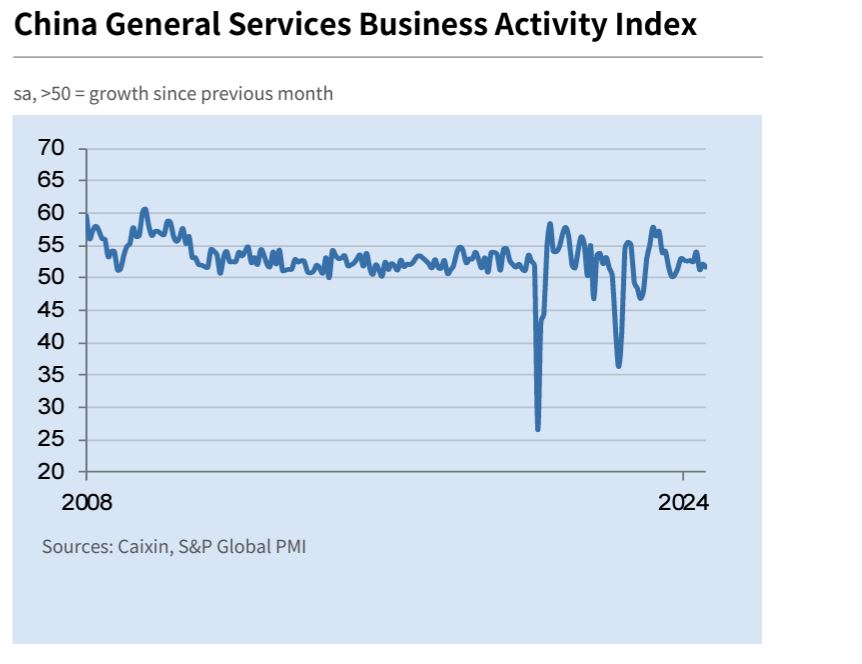

China’s service sector-maintained growth in August 2024, with strong business activity and new inflows. The seasonally adjusted Caixin China General Services Business Activity Index was 51.6 in August, slightly lower than July’s 52.1.

This marked the 37th consecutive month of expansion, although the rate of growth was among the lowest seen so far this year, according to a latest report unveiled by the S&P Global on Wednesday.

New business inflows continued to support the expansion of service activity in August. Chinese service providers attributed this growth to improved underlying demand conditions and a wider range of service offerings.

While new work inflows expanded at a slower pace compared to July, they remained in growth territory. Additionally, export business witnessed an accelerated increase, driven by rising interest from overseas clients, particularly in the tourism industry.

Employment decreased in August following an increase in July, despite a rise in unfinished business. Job losses were attributed to resignations and redundancies aimed at reducing costs.

Average input prices continued to rise in the Chinese service sector, with the rate of cost inflation accelerating to the highest level since June 2023. However, selling prices fell for the first time in seven months, albeit marginally. Rising competition prompted service providers to lower prices and offer discounts to support sales.

The Composite Output Index, which measures the overall activity of both manufacturing and services sectors, remained unchanged at 51.2 in August, the report added.

Chinese business activity expanded for the tenth consecutive month in August, maintaining a subdued pace similar to July. While manufacturing output grew faster, services activity expanded at a slower rate.

New orders in the manufacturing sector improved, but services new business growth slowed down. Overall, growth accelerated from July.

Attribution: S&P Global report