Turkish inflation expected to ease for first time in eight months

Turkish inflation is expected to show signs of deceleration, sending some relief from a prolonged cost-of-living crisis where price hikes mounted above 75 per cent.

According to a Bloomberg survey of economists, data due on Wednesday are expected to reveal that annual inflation dipped to 72.6 per cent in June, marking the first slowdown in eight months.

Monthly price growth, a key indicator for the Central Bank of the Republic of Turkey (CBRT), is anticipated to have slowed to 2.2 per cent, the lowest in over a year.

This easing, comes as domestic demand, shows signs of weakening, bolstered by an aggressive monetary tightening cycle that witnessed the key interest rate hikes by more than 40 percentage points to 50 per cent within a year.

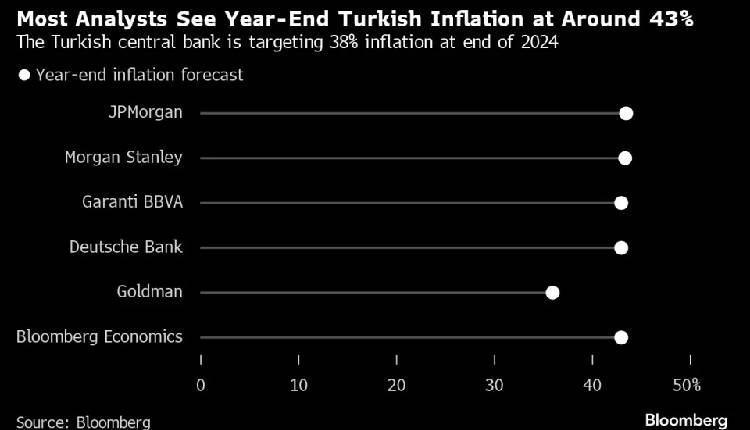

Optimism among officials suggests that this relief could signal the beginning of a rapid disinflation period. However, many economists forecast inflation to end the year above the central bank’s target of 38 per cent, with a significant slowdown in July and August influenced largely by statistical factors related to high bases in 2023.

Deutsche Bank AG analysts, including Christian Wietoska, anticipate strong disinflation in the coming months due to slowing domestic demand, projecting the headline rate to drop to “the low 50s” by the end of August.

Investors are closely monitoring these developments as they increase investments in local assets. The trajectory of inflation ahead will also dictate when policymakers consider reintroducing rate cuts, despite their current hawkish stance aimed at maintaining tight monetary policy until a sustained decline in inflation is observed.

Treasury and Finance Minister Mehmet Simsek emphasised the importance of bringing inflation below 42 per cent, which is the upper limit of the central bank’s year-end forecasts, though still significantly above the official target rate of 5 per cent.

Attribution: Bloomberg