U.S. Fed keeps key interest rates unchanged, foresees three upcoming cuts in 2024

The U.S. Federal Reserve has on Wednesday kept its key interest rates unchanged for the third straight time and set the table for multiple upcoming cuts in 2024 and beyond.

With the inflation rate easing and the economy holding in, the policymakers on the Federal Open Market Committee (FOMC) voted unanimously to hold the benchmark overnight borrowing rate in a targeted range between 5.25 percent -5.5 percent.

Along with the decision to stay on hold, the committee penciled in at least three rate cuts to come in 2024, assuming quarter percentage point increments. This is less than market pricing of four. However, it is more aggressive than what officials had previously indicated.

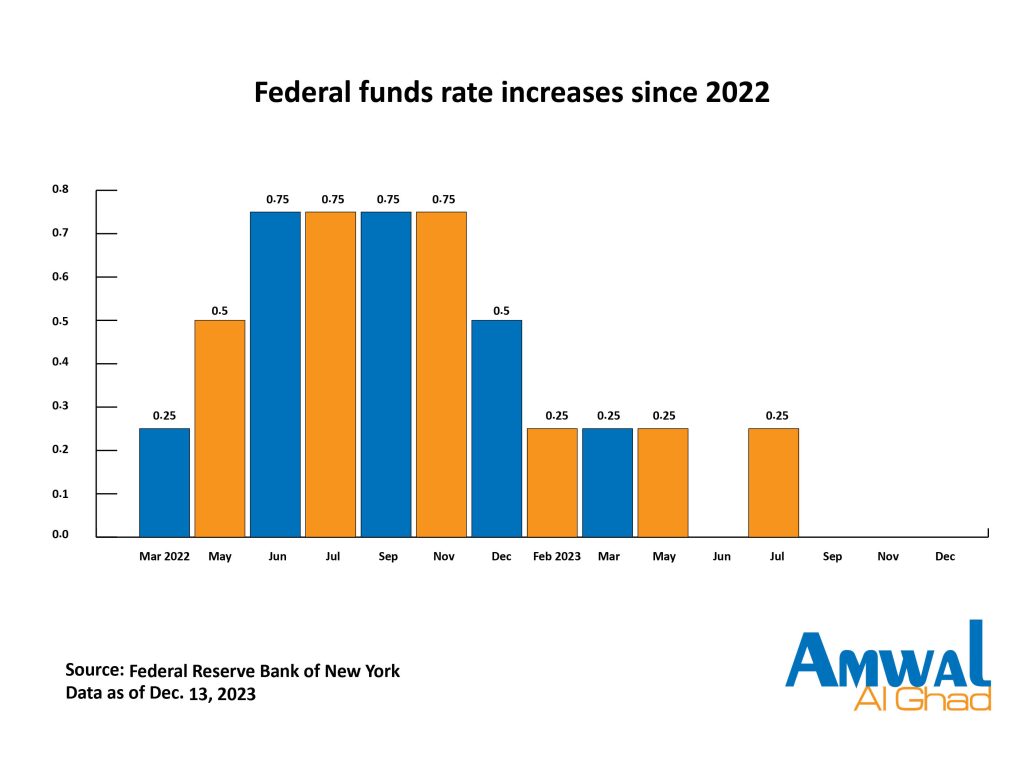

This could end a cycle that has witnessed 11 hikes – the fastest increases in four decades — which pushed the fed funds rate to its highest level in more than 22 years. However, there was uncertainty about how ambitious the FOMC might be regarding policy easing.

The FOMC’s “dot plot” of individual members’ expectations signals another four cuts in 2025, or a full percentage point. Three more cuts in 2026 would push the Fed funds rate down between 2 percent -2.25 percent, close to the long-run outlook, but there was considerable dispersion in the estimates for the final two years.

Speaking at a news conference, Fed Chair Jerome Powell said the Federal Reserve is likely done raising rates because of how steadily inflation has come down.

“Inflation keeps coming down, the labor market keeps getting back into balance and, it’s so far, so good,” Powell said.

The Fed chair expressed optimism that inflation, which has bedeviled American consumers and businesses for more than two years, is going down toward the Fed’s 2 percent target. Powell noted, by example, that inflation has cooled in goods, housing and services — three categories the U.S. Fed has been closely monitoring.

Powell downplayed one concern that some economists have expressed — that the final step down to 2 percent inflation, from its current level of about 3 percent, could be harder than the previous slowdowns in price hikes.

“We kind of assume that that it will get harder from here,” he added. “But so far it hasn’t.”

The Fed kept its benchmark rate at about 5.4 percent, its highest level in 22 years, a rate that has contributed to much higher costs for mortgages, auto loans, business borrowing, and many other forms of credit. Higher mortgage rates have sharply decreased home sales. Spending on appliances and other expensive goods that people often buy on credit has also fallen.

Conversely, the anticipated interest rate cuts by the U.S. Fed, whenever they took place, would reduce borrowing costs across the economy. Stock prices could increase, too, though share prices have already rallied in expectation of rate cuts, potentially limiting any further hikes.