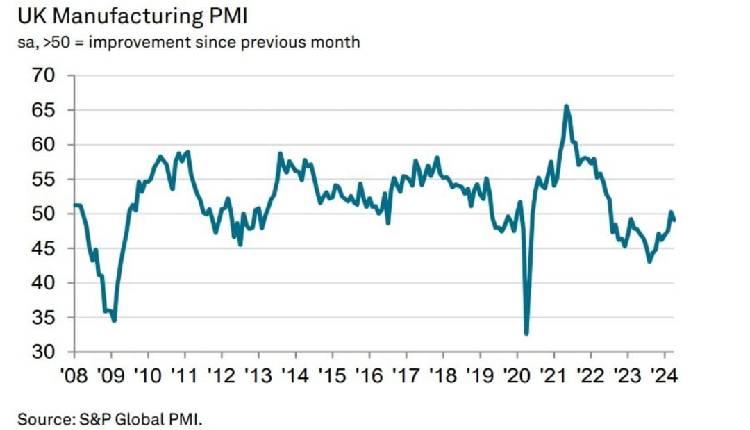

The UK manufacturing sector has entered a phase of contraction, with the S&P Global UK Manufacturing PMI falling to 48.9 in April, down from 55.2 in March, according to a Wednesday release.

This marks the first output decline since January 2021, as both output and new orders have decreased. Despite the economic slowdown, business optimism remains positive, and input cost inflation is still close to March’s survey-record high.

The data, collected between April 12 and 27, 2022, indicates a challenging period ahead for UK manufacturers.

Rob Dobson, Director at S&P Global Market Intelligence, commented on the unwelcome combination of slower growth and high inflation affecting the sector.

“The UK manufacturing sector suffered a renewed downturn in April, as output and new orders contracted following short-lived rebounds in March.

“The UK manufacturing sector suffered a renewed downturn in April, as output and new orders contracted following short-lived rebounds in March. The sector is still besieged by weak market confidence, client destocking and disruptions caused by the ongoing Red Sea crisis, all of which are contributing to reduced inflows of new work from domestic and overseas customers, with specific reports of difficulty securing new contract wins from Europe, the US and Asia.” Dobson stated.

“The downturn is also sustaining cost caution at manufacturers, leading to lower employment, stock holdings and cutbacks in purchasing activity. The news on the prices front is also worrisome for those looking for a sustainable path back to target (consumer price) inflation, with cost pressures growing in industry and feeding through to higher selling prices at the factory gate.”