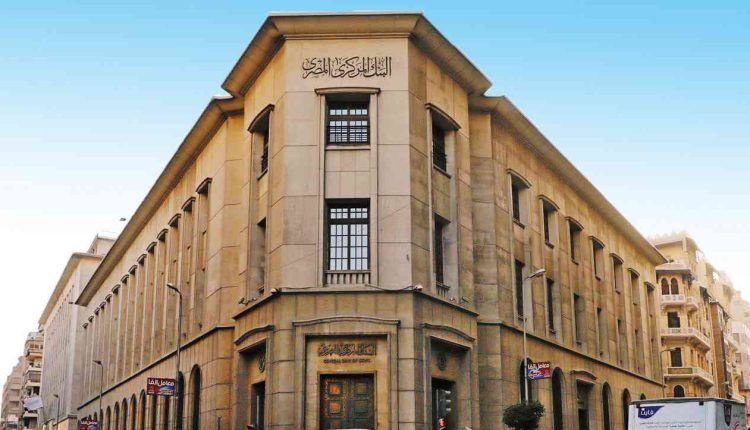

URGENT: Egypt’s central bank provides funds necessary for maintaining FX liquidity

Overnight deposit and lending rates and the main operation rate hit 27.25%, 28.25% & 27.75%, respectively

In an extraordinary meeting on Wednesday, the Central Bank of Egypt’s the Monetary Policy Committee (MPC) decided to free float the exchange rate of the local currency. It also increased the interest rates by 6% at once, bringing the overnight deposit and lending rates and the main operation rate to 27.25%, 28.25% and 27.75%, respectively. The credit and discount rates were also raised by 600 basis points to 27.75%. CBE also announced that it provided the funds necessary for maintaining foreign exchange liquidity.

CBE stated said that unifying the exchange rate comes within the framework of its mandate of safeguarding the prerequisites for sustainable development and contributing to eliminating the accumulation of demand for foreign exchange in the wake of closing the gap between the official and parallel market exchange rates.

“The goal of speeding up the monetary tightening process is to drive down inflation, guarantee a drop in monthly inflation rates, and raise real interest rates to positive levels,” the statement reads.

It pointed out that monetary tightening could lead to a decline in real credit granted to the private sector in the short term, but the rise in inflationary pressures poses a greater threat to the stability and competitiveness of the private sector. It stressed that achieving price stability creates an encouraging climate for investment and sustainable growth for the private sector in the medium term.

CBE pointed out that the latest monetary policy decisions come within the framework of a comprehensive economic reform package in coordination with the Egyptian government and with the support of bilateral and multilateral partners, and in preparation for implementing the reform programme measures.