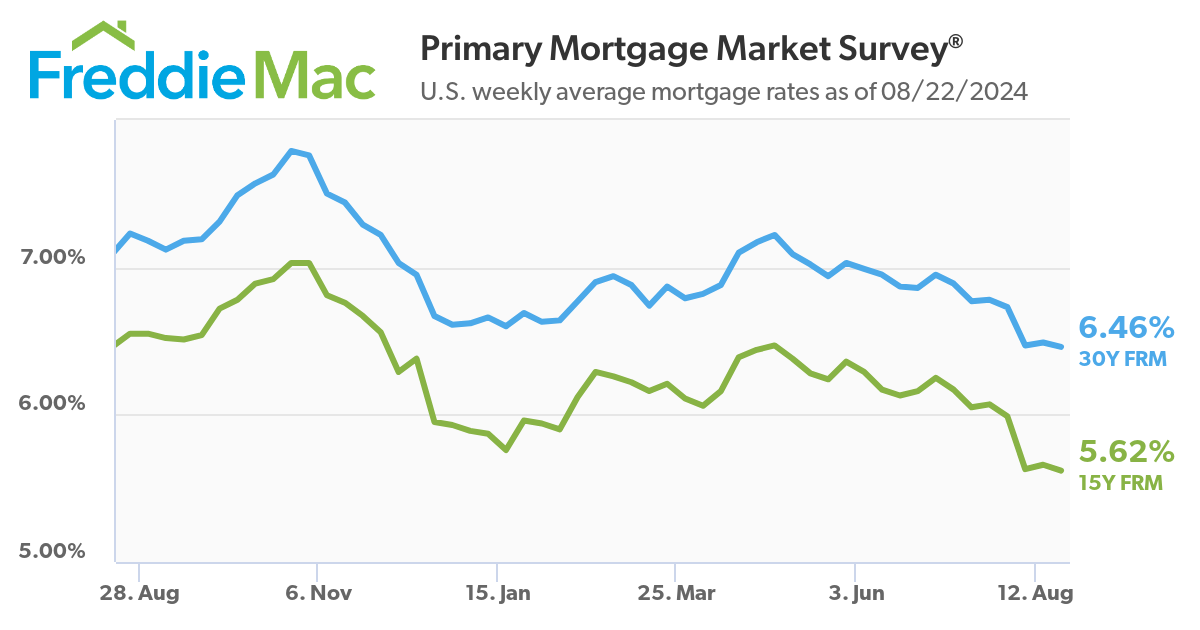

The average rate on the popular US 30-year fixed-rate mortgage has fallen to its lowest level since May 2023. According to Freddie Mac, the rate decreased to 6.46 per cent during the week ending August 22, down from 6.49 per cent the previous week.

While this decline is encouraging, experts believe that further reductions are necessary to significantly boost demand in the housing market.

“Although mortgage rates have stayed relatively flat over the past couple of weeks, softer incoming economic data suggest rates will gently slope downward through the end of the year,” stated Sam Khater, Freddie Mac’s Chief Economist.

“Earlier this month, rates plunged and are now lingering just under 6.5 percent, which has not been enough to motivate potential homebuyers. We expect rates likely will need to decline another percentage point to generate buyer demand.”

Despite the recent decline in mortgage rates, home sales remain relatively slow. The National Association of Realtors reported a slight increase of 1.3 per cent in existing home sales during July, but the overall market activity is still below pre-pandemic levels.

While lower interest rates are improving affordability, buyers are also benefiting from increased housing inventory, providing them with more choices.

Attribution: Reuters & Freddie Mac’s Primary Mortgage Market Survey (PMMS)