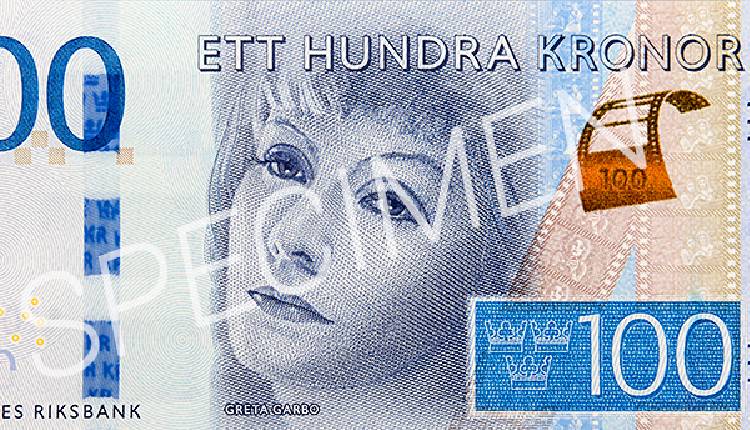

The World Bank has issued a 10-year Swedish krona-denominated benchmark bond, raising SEK 3 billion (approximately $270 million).

Maturing on October 10, 2034, the bond offers an annual coupon rate of 2.5 per cent and was priced at 98.422 per cent. Nordea Bank Abp acted as the lead manager for the transaction, with the bond primarily placed with Nordic investors.

The issuance supports the World Bank’s efforts in the international debt markets, providing investment opportunities while backing global development initiatives.

Attribution: World Bank

Subediting: M. S. Salama