Would the global trade come to a standstill as supply chain crisis worsens?

Unfortunately, Moody's Analytics warns supply chain disruptions "will get worse before they get better."

The US-China trade war, climate change, and the global pandemic have started a disruption in supply chains that spread like wildfire around the world.

Major industries including automotive, electronics, pharmaceuticals, medical equipment and supplies, consumer goods and more have been significantly affected by the global supply chain disruptions that have been plaguing manufacturers and retailers. From Liverpool to Los Angeles, Beijing to Berlin, the world is in the grip of a supply crunch.

The pandemic is the main culprit as it has disrupted the global supply chain system, causing distortions in supply and demand in certain industries, which are transmitted along the supply chain, causing a wider supply crunch.

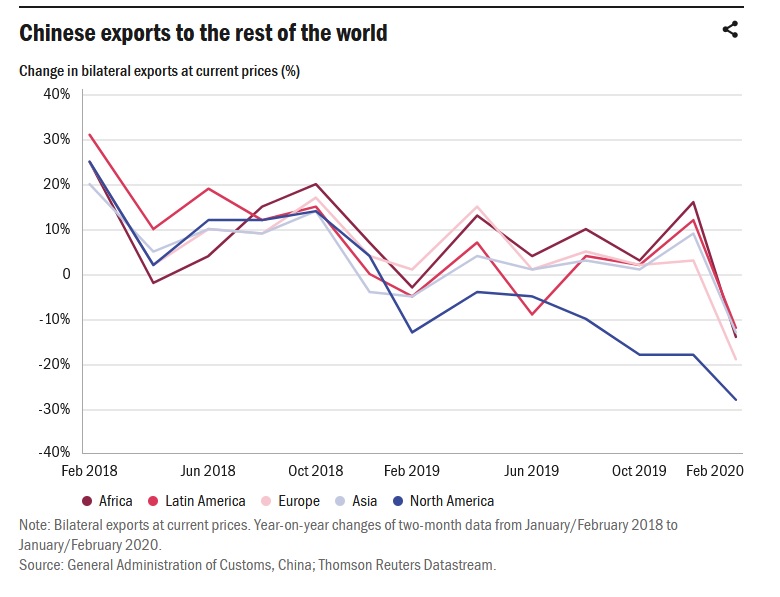

The supply chain crisis has started at the beginning of the pandemic in China as business activity and transportation has been restricted. It is well known that much of manufacturing production world-wide has been organized in what has become known as global value chains (GVCs) and China is at the heart of such GVCs.

The Chinese authorities reacted to the coronavirus pandemic by imposing severe restrictions on movements of people, effectively imposing curfews and quarantines across the country from the end of January onwards; a step that has resulted into major disruptions to the global trade.

The Chinese imports declined by 4 per in January and February combined from the same period a year earlier, while exports dropped by 17 per cent over the same time period, according to the official Chinese trade statistic.

Supply Chain Disruptions are getting from bad to worse

The global supply chain crunch is not looking good and it seems that the crisis is getting from bad to worse as the energy shortfall in China forces factories to cut down their operations.

The global economy gradually recovers from the impact of COVID-19 pandemic, yet worldwide supply crunch is intensifying. Near term relief for the global supply chain disruption is not around the corner.

The supply disruptions in the past are simply incomparable compared to the severe inventory crunch of 2021. Industry insiders predict that both large and small enterprises will be affected by this supply shortage.

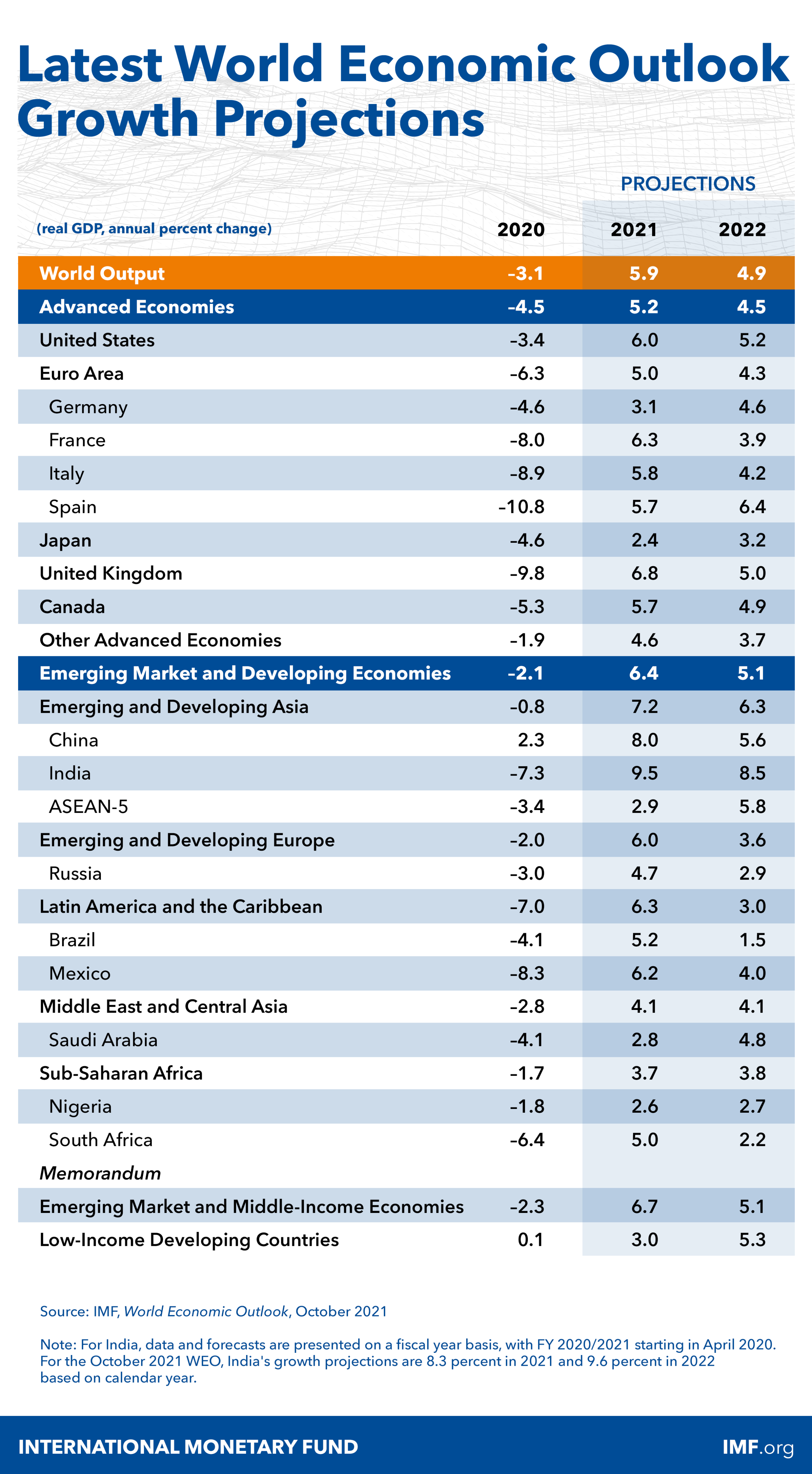

The supply disruptions have led The International Monetary Fund to be less optimistic about the global economy for 2021. In its World Economic Outlook; it expects global gross domestic product to grow by 5.9% this year — 0.1 percentage points lower than its July estimate.

According to the IMF, supply chain disruptions together with increasing raw material prices are also a reason for the rise of consumer prices.

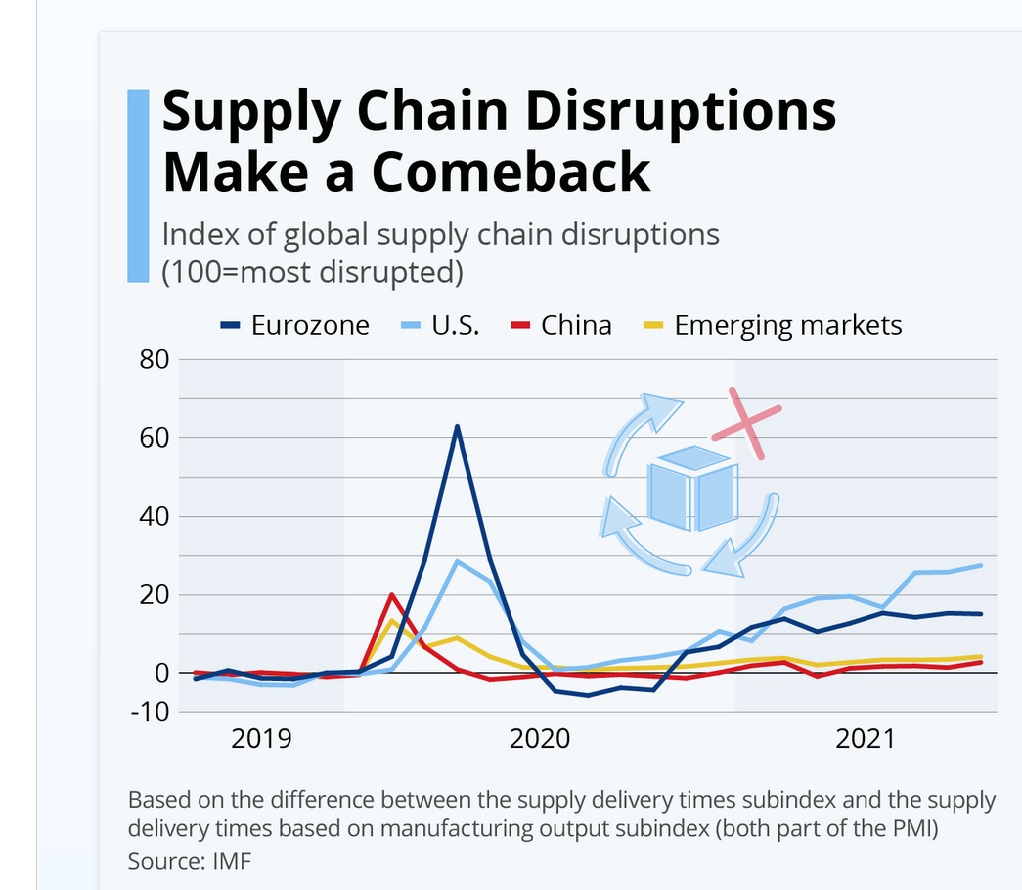

Furthermore, components of the International Monetary Fund’s purchasing managers’ index show how supply chain disruptions have developed during the pandemic, spiking in early 2020 and picking back up over the course of 2021 as the new normal causes all types of goods to become more sought amid a more permanent reopening.

The index is calculated by the IMF using the difference between delivery time and production indices of the PMI. The higher the value, the more disturbances occur in global supply chains.

On the other hand, Moody’s warned that there are “dark clouds ahead” because several factors make overcoming the supply constraints particularly challenging. “As the global economic recovery continues to gather steam, what is increasingly apparent is how it will be stymied by supply-chain disruptions that are now showing up at every corner,” Moody’s wrote in a report.

Flavio Romero Macau, a supply chain expert at Edith Cowan University in Western Australia, says that massive pent-up consumer demand in the wake of the pandemic has strained the world’s delicately balanced economic ecosystem.

What’s causing the disruptions?

The coronavirus wreaked havoc on global supply chains last year, as lockdowns temporarily closed factories and disrupted the normal flow of trade. Economic activity slowed dramatically at the start of the pandemic, and the rapid rebound in trade volumes that followed caught companies off guard.

Furthermore, COVID-19 pandemic has a lingering effect on the supply chain around the world as it essentially resulted into reducing the production of goods and services. The supply-chain shortages now happening are the result of struggles to return to pre-pandemic levels.

Steve Ricchiuto, chief U.S. economist at Mizuho Securities said that the result of imbalance between supply and demand eliminated the entire inventory and eliminated all the grease that allows the wheels of commerce to work smoothly.

A pickup in manufacturing and seemingly insatiable demand from housebound consumers for goods such as televisions, furniture and exercise bikes has stretched suppliers and made it difficult for consumers to find the products they’d like to buy.

Despite that the supply disruptions were initially tied to shutdowns of businesses when the pandemic hit, they have spread to a much broader spectrum of areas and are proving more difficult to tackle.

US seaborne imports were nearly 30% higher in February 2021 when compared to the same period a year earlier and 20% up on February 2019, according to S&P Global Panjiva.

The import surge in the United States and elsewhere has led to a worldwide container shortage. Everything from cars and machinery to apparel and other consumer staples are shipped in these metal boxes.

The coronavirus pandemic wreaked havoc on global supply chains. The vast network of ports, container vessels and trucking companies that move goods around the world are now badly congested due to a rapid rebound in demand for goods.

The influx of imports has compounded problems at choked up ports, which are contending with labor shortages due to Covid-19 and a slowdown in operations caused by social distancing measures and quarantines.

In addition, the disruption to global supply chains is getting worse ahead of the holidays, spurring shortages of some products, delays and higher prices for consumers.

The main cause of the current supply chain crisis may also be the increase in freight costs as the average cost to ship a 40-foot container shot up from $1,040 last June to $4,570 on March 1, according to S&P Global Platts. These expenses mean higher prices for consumers, adding upward pressure to rising inflation. Companies have so far said very little about how they plan to respond to soaring freight rates but there are early signs that import prices are rising

Consequences of continued disruption

The supply chain nightmare is proving to be stressful, increasing prices for consumers and slowing the global economic recovery. Unfortunately, Moody’s Analytics warns supply chain disruptions “will get worse before they get better.”

The global economic recovery from the coronavirus pandemic is weakening and risks are rising, according to the International Monetary Fund. As a result the IMF slashed its 2021 growth forecast for the United States by one full percentage point to 6%, the biggest reduction suffered by any G7 economy in its latest World Economic Outlook.

The revision comes days after Goldman Sachs cut its growth forecasts for the US economy this year and next, citing weaker consumer spending and the winding down of the government’s Covid-19 relief programs.

The IMF also cuts its 2021 growth forecasts for China, Japan and Germany, the world’s next largest economies. It said that shortages of materials were weighing on manufacturing output in Germany, while in Japan emergency coronavirus measures implemented between July and September had dented the recovery.

Supply chain bottlenecks have led to shortages of a range of goods and astronomical increases in shipping costs, which are pushing up consumer prices, the IMF added.

On the other hand, China’s economy hit its slowest pace of growth in a year in the third quarter, hurt by power shortages, supply chain bottlenecks and major wobbles in the property market.

The world’s second-largest economy is facing several major challenges, including the China Evergrande Group debt crisis, ongoing supply chain delays and a critical electricity crunch, which sent factory output to its weakest since early 2020, when heavy COVID-19 curbs were in place.

Furthermore, congestion at ports, factory closures, soaring freight charges and an acute shortage of transport workers is likely to get worse, the International Chamber of Shipping and allied transport groups have warned.

Neil Shearing, the chief economist at Capital Economics, said the UK and the US were most at risk from overheating into inflation, leading to central bank action. “Risks are generally skewed to the upside and there is a real possibility that inflation increases to a much higher rate that would, in time, necessitate a more substantial tightening of policy,” he said.

Shortage of semiconductor chips is one of the main results of the supply chain crunch

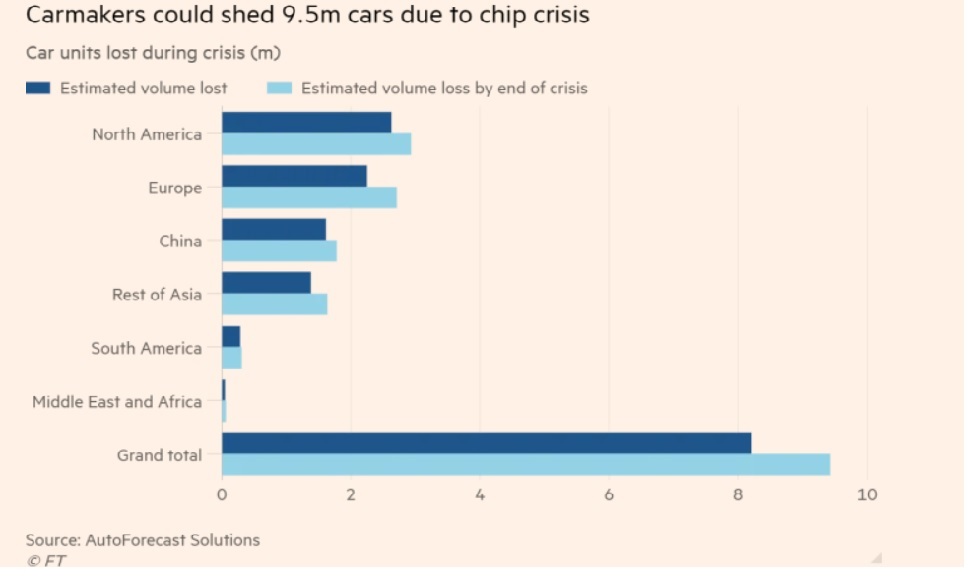

The supply chain disruption has created a global semiconductor chip shortage impacting automotive, industrial, and communications products, among others. The main reason for the supply squeeze in the car market was that demand had picked up “dramatically”, which he said was good news for the industry.

As the shortage of semiconductor processing chips continues to impact the automotive and technology industries, several leading car makers have been forced to close production lines temporarily.

The auto industry’s continuing troubles trace back to the early days of the pandemic, when auto suppliers canceled chip orders because of concern over weak demand, analysts and industry executives say.

The pandemic outbreak has badly affected many supply chains, but the supply chain issues in the semiconductor business fell particularly heavily on the auto industry, with big auto brands like BMW and Volkswagen, Ford and General Motors all warning of the impact of the chip shortage on production.

Major carmakers, including Ford and Volkswagen, have been forced to idle factories because of a shortage of computer chips caused by high demand for smartphones, gaming systems and other tech gadgets.

Consumer prices surged by 5.4% in September 2020, while new car prices rose by the fastest pace since 1980, a reflection of the worldwide computer chip shortage that has forced Ford (F), General Motors (GM) and other manufacturers to slash production.

A recent report released by consulting firm AlixPartners said the chips crisis will cost the global auto industry $210 billion in revenues this year. That’s almost double its estimate in May of $110 billion.

In addition, data provider AutoForecast Solutions forecast 9.5m vehicles could be lost because of the crisis in its latest survey.

Automakers, which rely on dozens of chips to build a single vehicle, were forced to halt production lines globally as they await chip supplies. The crisis is likely to cost the auto industry $450 billion in global sales from the start of the crisis through the end of 2022, according to Seraph Consulting.

The semiconductor chips shortage that is disrupting global car production could continue into 2022 and even 2023, a leading German car industry figure has said as the global semiconductor shortage that has paralyzed automakers for nearly a year shows signs of worsening.

In its September 2021 edition, the Institute for Supply Management–Greater Grand Rapids wrote there is “no end in sight” in the nationwide crisis impacting automotive customers, dealers and manufacturers. Forecasters believe it could last for at least another year.

The number of cars built in UK factories fell by 27% year-on-year to 37,200 in August, according to lobby group the Society of Motor Manufacturers and Traders (SMMT). That was down from 51,000 in the same month in 2020, when carmakers were racing to make up for time lost to lockdowns.

How long before things return to normal?

The US government is increasing its efforts to end the supply chain nightmare that has led to shortages of some goods, higher prices for consumers and now threatens to slow the economic recovery.

The Biden Administration has pledged to help “unkink” the supply chain bottlenecks that started in 2020 and then gained significant momentum in 2021 in a report called “Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth” issued by the White House.

The ongoing supply chain crisis isn’t going to end anytime soon, according to a new survey of chief financial officers polled by Duke University. The majority of the CFOs, who represent a wide range of businesses across multiple industries, expect the challenges to last “well into” 2022. They warned their companies are experiencing supply chain disruptions that have fueled production and shipping delays as well as an increase in materials prices.

However, JPMorgan Chase CEO Jamie Dimon’s expectations tend to a more optimistic point of view telling reporters that there is a “very good chance” that a year from now “we won’t be talking about supply chains at all.”

The widespread supply chain disruptions severely affecting manufacturers and retailers across the world will probably work themselves out over the next few months, chief executives of the largest US banks have said cited by the Financial Times.

The shipping mess that’s making online orders a nightmare is already healing, Jefferies economists also anticipated. There are signs that “we are past the peak pinch” on the cargo ship delays, port bottlenecks, and labor shortages that have disrupted worldwide supply chains for months, according to economists led by Aneta Markowska.