Foreign investors significantly reduced their holdings of Japanese stocks in the week ending July 26th, driven by a strengthening yen and a global sell-off in technology shares.

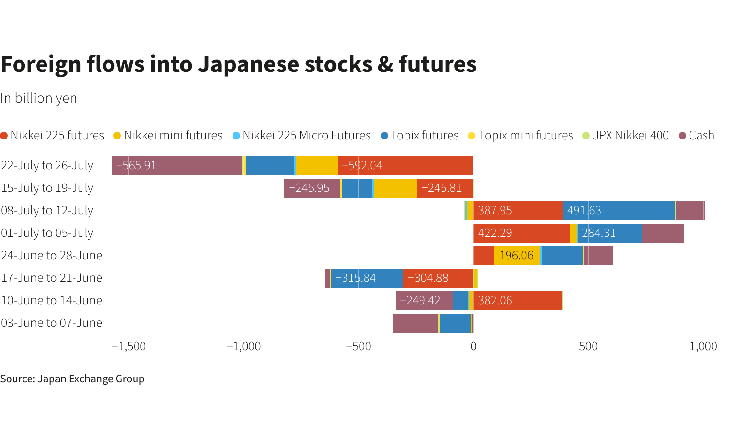

The net selling amounted to 1.58 trillion yen ($10.53 billion), marking the largest outflow since September 29, 2023. This included 1.01 trillion yen in derivative contract sales and 1.58 trillion yen in cash equity divestments.

The Topix index plummeted 5.64 per cent during the week, marking its steepest decline since March 2020. The Nikkei share average also suffered a 5.98 per cent drop.

The yen’s appreciation to a 15-month high of 148.48 per dollar, following the Bank of Japan’s (BOJ) interest rate hike and bond-buying reduction, raised concerns about the profitability of Japanese exporters.

Despite the overall outflow, foreign investors purchased long-term Japanese bonds worth 1.2 billion yen, reversing the previous week’s net selling of 352.7 billion yen. However, they also sold 2.64 trillion-yen worth of short-term debt instruments.

Japanese investors, on the other hand, offloaded 700.5-billion-yen worth of long-term overseas bonds, extending net selling to a third week.

Conversely, they purchased 14.5-billion-yen worth of short-term foreign instruments. Additionally, Japanese investors acquired 230.4-billion-yen worth of foreign equities, marking the second consecutive week of net buying.

Attribution: Reuters