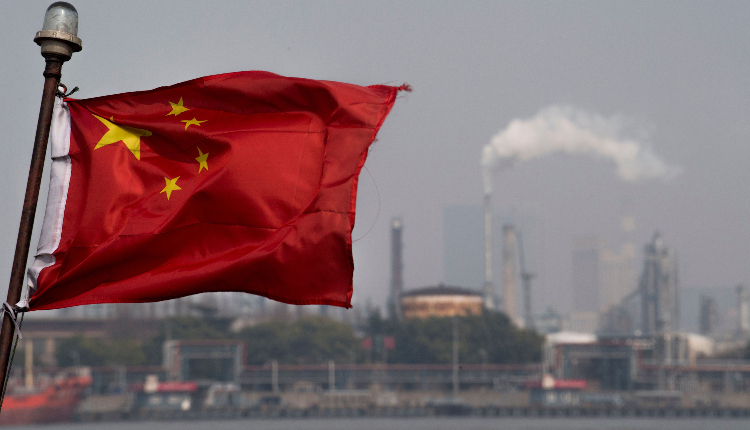

China’s industrial profits dropped sharply in September, reflecting deflationary pressures impacting corporate finances. Profits of large companies experienced a 27.1 per cent fall compared to a year ago, following a 17.8 per cent decrease in August.

Profits for the first nine months of the year also decreased by 3.5 per cent compared to the same period in 2023. The National Bureau of Statistics attributed the decline to various factors, including a high base in the same period last year.

Industrial profits are a crucial indicator of the financial well-being of factories, mines, and utilities, influencing their future investment decisions. Declining profits reflect the economic challenges in China’s $18 trillion economy, leading to measures like interest-rate cuts since late September.

Investors are eagerly awaiting the upcoming sitting of the country’s top legislative body in Beijing from Nov. 4 to 8. They hope for approval of additional fiscal stimulus to boost growth.

Economists anticipate the meeting will approve a plan to refinance local government debt and issue sovereign bonds to bolster banks. Investors are eager for increased public borrowing and spending, but there is uncertainty about whether it will happen this year.

Despite faster growth in industrial output, deepening deflation in producer prices is expected to impact company earnings. Factory-gate prices have declined for 24 consecutive months, with the recent drop intensifying due to weak domestic demand.

China’s economic growth slowed in the Q3, expanding by 4.6 per cent year-on-year, the slowest pace since March 2023. Despite this, there were some positive signs in September, such as improved industrial performance and increased consumption.

The high-technology sector showed promise, with manufacturers’ profits rising by 6.3 per cent in the first nine months of the year, according to the statistics bureau.

Attribution: Bloomberg

Subediting: M. S. Salama