Australia’s core inflation unexpectedly slowed in the last quarter, supporting the Reserve Bank of Australia’s (RBA) stance that prices will gradually ease and prompting increased market speculation about a potential interest rate cut. As a result, the Australian dollar and bond yields fell.

Data released on Wednesday showed that the trimmed mean inflation gauge, which excludes volatile items, rose by 3.9 per cent in the second quarter, down from 4 per cent in the previous period.

Meanwhile, the consumer price index rose 3.8 per cent in the three months through June from a year earlier, in line with expectations.

Following the inflation report, traders abandoned bets on a rate hike at the RBA’s meeting next week and instead priced in a 67 per cent chance of a rate cut in December.

The Australian currency dropped as much as 0.8 per cent, and yields on three-year government bonds fell by 25 basis points, while stocks surged.

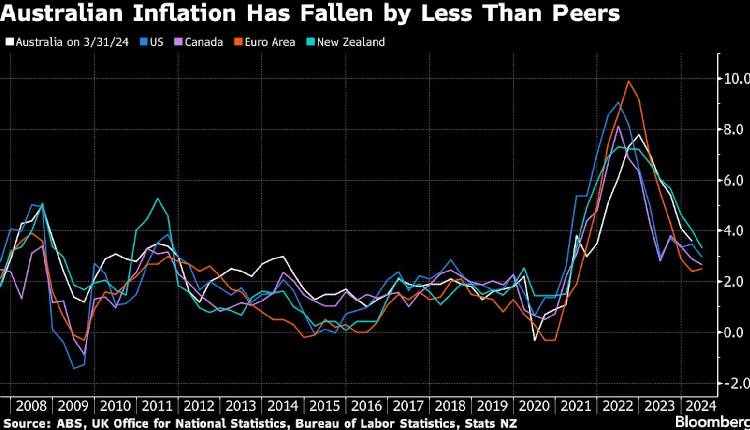

Annually trimmed mean inflation has now slowed for six consecutive quarters, down from a peak of 6.8 per cent in the fourth quarter of 2022. This disinflationary trend boosts confidence among policymakers that they can maintain employment gains while steering the economy towards a soft landing.

“There will likely have been a huge sigh of relief at the RBA,” said Su-Lin Ong, chief economist at the Royal Bank of Canada in Sydney. “It will still likely debate a rate hike next week but will deliver a steady rate verdict and continue to signal vigilance with returning inflation to target the priority.”

The RBA has been more cautious in raising rates compared to its global counterparts due to concerns about the ability of heavily indebted households to cope with higher mortgage repayments.

The cooling in prices indicates that the central bank is on track to return inflation to its 2–3 per cent target by late next year without further action.

Attribution: Bloomberg