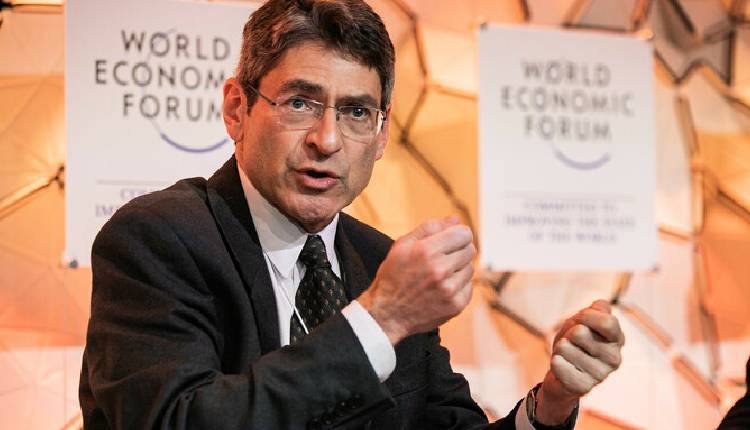

More flexibility in UK’s labour market is necessary to ensure inflation remains at 2 per cent, Jonathan Haskel, a policymaker at the Bank of England (BoE), stated on Tuesday at a seminar at City University’s Bayes Business School, highlighting the central role of the labour market in influencing inflation.

The BoE had predicted last month that inflation would dip below 2 per cent in Q2 2024 before climbing towards 3 per cent later in the year, however, BoE Deputy Governor Dave Ramsden recently suggested that inflation might stay close to 2 per cent.

In March, consumer price inflation fell to 3.2 per cent from February’s 3.4 per cent, while unemployment rose to a six-month high of 4.2 per cent in the three months to February. Despite this, wage growth remained at 6.0 per cent, approximately double the rate most BoE policymakers consider consistent with 2 per cent inflation.

Haskel noted that the tightness of the labour market, as indicated by the ratio of job vacancies to unemployment, was decreasing, albeit “rather lowly.” He doubted the decrease was fast enough to control inflation.

Haskel, whose term on the BoE’s Monetary Policy Committee concludes on August 31, ceased voting for higher interest rates last month, six months later than the majority of the committee. Financial markets are currently predicting the first cut in BoE rates from their 14-year peak of 5.25 per cent to occur in June or August.

He also mentioned that the UK’s labour market was tight even before the COVID-19 pandemic; however, his research suggested that this only played a minor role in the price surge that led to a 41-year inflation high of 11.1 per cent by October 2022.

The main factors were a rise in energy prices preceding Russia’s full invasion of Ukraine, supply chain difficulties that became apparent in the second half of 2021, and a subsequent increase in food prices.