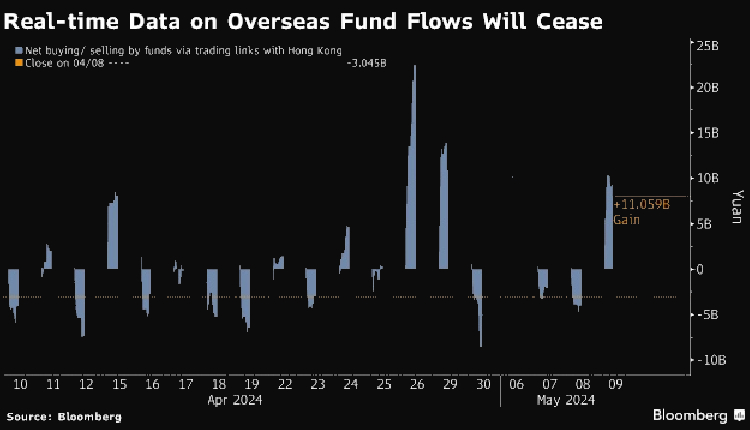

China is set to discontinue real-time displays of foreign stock purchases and sales on Monday, in a move aimed at bolstering investor confidence, Bloomberg reported on Sunday.

This decision by the Shanghai and Shenzhen stock exchanges removes a potential source of negative data perceived to impact market sentiment.

The two exchanges will no longer show real-time data on stock trades with Hong Kong. They will now provide daily turnover information and list the top 10 most-traded stocks through the northbound channel.

Officials claim this aligns with international practices. However, some analysts suggest it’s also an attempt to shield the market from the psychological impact of data showing foreign capital flight.

Despite the data change, Chinese stocks have experienced a rally since the announcement. This uptrend is attributed to a combination of factors, including attractive valuations, government efforts to stabilise the housing market, and a return of foreign investment.

Fund managers like Chen Shi of Shanghai Jade Stone Investment believe the shift won’t significantly impact long-term investors who rely on fundamentals. He sees the intraday data as largely “noise” for those focused on value.

However, the removal of live data may affect retail investors who previously relied heavily on it. These investors, who still dominate the market, were susceptible to sentiment swings triggered by intraday outflows.

Despite concerns, the overall impact of foreign investors on the Chinese market is relatively small. On average, northbound trading accounts for only 15 per cent of the daily turnover.

Many analysts, like Yang Bo of Shenzhen Zhuode Investment Management, view the change positively. They believe it will reduce volatility driven by emotional reactions and foster long-term market stability.