Chinese commercial banks are experiencing a decline in net profit growth, attributed to lower interest rates on loans and shrinking net interest margins, according to a National Financial Regulatory Administration (NFRA) official.

Liao Yuanyuan, director of the Statistics and Risk Surveillance Department at the banking sector regulator, stated that the average interest rate on new corporate loans issued in the first seven months of 2024 fell by 39 basis points compared to the same period last year.

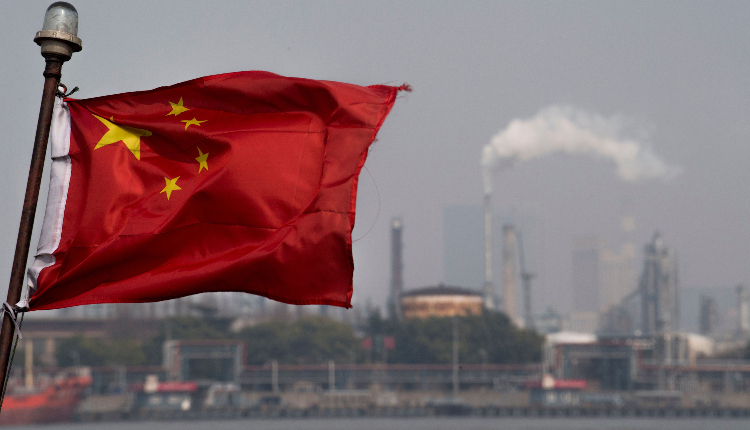

China’s banks are under pressure to offer cheaper loans to boost the economy, but demand is low due to a sluggish property market and weak consumer spending, impacting their profitability.

The NFRA has urged banks to improve their management practices and explore new avenues for profit growth. Xiao Yuanqi, deputy head of the NFRA, assured that banks and insurance institutions still have sufficient resources to mitigate risks.

The regulator has also announced plans to strengthen supervision of major shareholders at small- and medium-sized financial institutions to control their financial risks. These institutions are being advised to focus on their core businesses and avoid “blindly pursuing excessive expansion.”

Additionally, the NFRA will continue to promote financial institutions to enhance their support for the property sector.

Commercial banks have already approved 5,392 property projects under the “whitelist” programme, which aims to inject liquidity into the struggling sector, with a total financing amount of nearly 1.4 trillion yuan ($196.25 billion).

The regulator will encourage local city governments to include more qualified property projects in the programme to address the financing needs of projects facing difficulties in raising capital.

Attribution: Reuters

Subediting: M. S. Salama