During Wednesday closing session, the Egyptian Exchange (EGX) has posted losses of EGP 3.6 billion as the capital market has amounted to EGP 393.870 million.

The EGX indices closed in red.

The main index, EGX30 sank by 1.25% to close at 5695.93 p. EGX20 pushed down by 1.40% to end at 6668.39 p.

Meanwhile, the mid- and small-cap index, the EGX70 edged down by 0.92% to conclude 536.07 pts. Price index EGX100 fell by 1.06% to finish at 879.23 p.

Traded volume reached 105.782 million securities worth EGP 401.789 million, exchanged 25.865 thousand transactions.

This was after trading in 174 listed securities; 123 declined 31 advanced while 20 keeping their previous levels.

EGX’s closing losses were driven by the Arabs’ selling pressures.

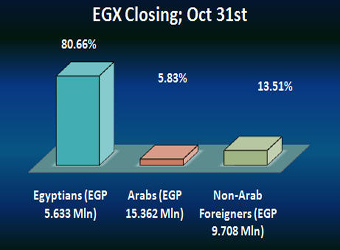

Arabs were net sellers seizing 5.83% of the total markets, with a net equity of EGP 15.362 million excluding the deals.

On the other hand, Egyptians and non-Arab Foreigners were net buyers 80.66% and 13.51% respectively, of the total markets, with a net equity of EGP 5.653 million and EGP 9.708 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed downwards.

Citadel Capital:

Citadel Capital (CCAP.CA)’s stock dived by 2.17% to conclude at EGP 4.05.

Orascom Construction Industries:

Orascom Construction Industries – OCI (OCIC.CA)’s stock dropped by 1.91% to close at EGP 258.21.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA)’s stock dipped by 1.64% to finish at EGP 0.60.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) pushed down by 1.62% to end at EGP 3.64.

The Egyptian Exchange (EGX) has suspended trading for Orascom Telecom Holding’s stock during Tuesday’s opening session. EGX said it awaits OTH’s reply as regards the news about VimpelCom’s plans to sell assets in emerging markets such as Burundi, Zimbabwe and Central African Republic.

As a result, Orascom Telecom Holding announced later on Tuesday that it is conducting a strategic review and valuation to its business in Burundi, Central African Republic and Zimbabwe “to identify, examine and consider a range of strategic alternatives”.

“Those strategic options include, but are not limited to, a sale of all or a material part of the Sub-Saharan African Operations either in one transaction or in a series of transactions,” it added.

The Financial Times reported yesterday that the Russian company has already started talks with potential buyers of its sub-Saharan African units in Burundi (U-Com Burundi) and the Central African Republic (Telecel-RCA). The company is also expected to offload its Zimbabwean business – Telecel Zimbabwe – after resolving outstanding ownership issues.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) went down by 1.50% to finish at EGP 11.79.