During Monday closing session, the Egyptian Exchange (EGX) has posted losses of EGP 1.46 billion as the capital market has amounted to EGP 393.111 million.

EGX indices closed in red.

The main index, EGX30 fell by 0.19% to close at 5712.41 p. EGX20 dipped by 0.10% to finish at 6669.38 p.

Meanwhile, the mid- and small-cap index, the EGX70 sank by 1.24% to conclude at 255.97 pts. Price index EGX100 went down by 1.10 % to end at 871.47 p.

Traded volume reached 101.983 million securities worth EGP 446.500 million, exchanged through 26.436 thousand transactions.

This was after trading in 178 listed securities; 105 declined 42 advanced while 31 keeping their previous levels.

EGX’s losses were due to Egyptians as well as Arabs’ profit-taking deals.

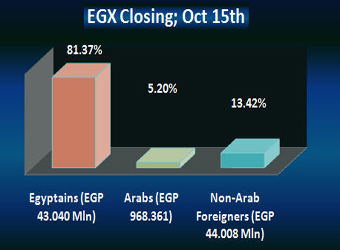

Egyptians and Arabs were net sellers seizing 81.37% and 5.2% respectively, of the total markets, with a net equity of EGP 43.040 million and EGP 968.361 thousand excluding the deals.

On the other hand, non-Arab Foreigners were net buyers seizing 13.42% of the total markets, with a net equity of EGP 44.008 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance during the closing.

Citadel Capital:

Citadel Capital (CCAP.CA)’s stock dived by 2.36% to close at EGP 4.24.

Citadel Capital (CCAP.CA on the Egyptian Exchange), the leading private equity firm in Africa and the Middle East, has been ranked the largest private equity firm in Africa for the fourth year in a row on the definitive global private equity league table.

News that Citadel Capital was again the largest African firm on the annual Private Equity International (PEI) 300 ranking came as the firm took home multiple peer-judged performance-based awards in London and Arusha, Tanzania.

The PEI 300, now in its sixth year, is the only global ‘apples-to-apples’ comparison of private equity direct investment programs. Citadel Capital was ranked the largest PE firm in Africa on the basis of US$ 3.5 billion in qualifying fundraising in the period spanning 2007-2012.

“It is without question that we are living in the earliest days of the African Century. Eight years after our founding, we are happy to note that the rest of the world is finally waking up to the scale of the opportunities Africa presents investors who focus not on resource extraction, but on building globally competitive industries and sustainable infrastructure,” said Ahmed Heikal, Chairman and Founder of Citadel Capital, which controls investments of US$ 9.5 billion spanning 15 industries.

Citadel Capital will recover some losses that were incurred because of falling asset values, Managing Director Stephen Murphy said on Monday.

“As the stock market recovers and asset values improve, that will have a positive impact on our numbers,” he said in an interview on the sidelines of a financial conference.

“The losses we reported are very notional. We had to write down the value of some assets in the past but now that the Egyptian stock market is up almost 45 percent since the beginning of the year, we can start writing them back.”

The stock market tumbled after the ousting of President Hosni Mubarak early last year but has begun to recover with signs of returning political and economic stability.

Murphy also said Citadel has no immediate plans to float any of its companies but is looking at selling at least three non-core assets.

“Each will hopefully bring us close to $50 million. This will positively impact our numbers.”

Citadel said earlier this month that its consolidated second-quarter net loss narrowed to 124.2 million Egyptian pounds ($20.4 million) from 180.5 million a year earlier.

The firm, which focuses on the Middle East and Africa, said assets under management increased by $228.8 million to $3.6 billion.

This year’s awards season has also seen Citadel Capital win other accolades including; Private Equity Firm of the Year — EMEA Finance magazine, Best Fundraising (for RVR) — EMEA Finance magazine, Best Transportation Deal in Africa (for river transport play Nile Logistics) — EMEA Finance magazine, African Infrastructure Deal of the Year (for RVR) at the Infrastructure Investor Awards, Regional Infrastructure Investment of the Year (for RVR) at the African Investor Infrastructure Awards, Best Buy and Build Private Equity House in Africa—ACQ Global, and Middle East Project Finance Deal of the Year (for ERC’s legal team)—International Financial Law Review (IFLR).

Orascom Construction Industries:

Orascom Construction Industries – OCI (OCIC.CA)’s stock went down by 1.79% to end at EGP 269.46.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) surged by 2.63% to finish at EGP 12.09.

Egypt’s regulator has no objections to EFG Hermes’ plan to create a jointly-owned investment bank with QInvest of Qatar, the bank said on Monday.

EFG-Hermes and QInvest agreed in May to hive off EFG Hermes’s investment banking business into a joint venture in which state-backed QInvest would hold a 60 percent stake.

EFG-Hermes shareholders in September reaffirmed their approval of the tie-up after demands by the regulator for more details were met. EFSA had had rejected decisions approved by shareholders in June because the firm had not clarified points including minority rights.

“The Egyptian Financial Supervisory Authority certified, with no reservations … (EFG Hermes’) Extraordinary General Meeting minutes that was held on Sunday Sept. 16, 2012 to approve the company’s strategic alliance with QInvest,” EFG Hermes said in a statement.

The statement was sent to the Egyptian and London stock exchanges (EGX) (LSE).

An spokeswoman for the Egyptian bank said no further approvals were needed from the Egyptian authorities.

Telecom Egypt:

Telecom Egypt (TE) (ETEL.CA)’s stock inched higher by 0.07% to end at EGP 13.73.

Telecom Egypt announced on Monday the retirement of Mr. Mahmoud Tag Eldeen, Vice President, Human Resources, in line with TE’s corporate policy and as he reaches the relevant age, with effect from 14 October, 2012.

Mr. Khaled Marmoush, Vice President, Information Technology, will also be leaving the company following the end of his contract, with effect from 15 October, 2012.

A replacement for both positions will be announced by the company in due course.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) witnessed no change at EGP 0.53.

Orascom Telecom Media and Technology Holding – (OTMT) announced that it received a notice whereby France Telecom will use its right to seek a cheque contract of general services and whereby this contract OTMT offers services for Mobinil (EMOB.CA) in addition to delayed dues.

Moreover, OTMT and France Telecom expect to sign transitional services contract with Mobinil in order to discuss ways to enhance cost structure of Mobinil as this contract will not impose extra cost on Mobinil.

Considering the cheque contract, delayed dues and signing new advisory services contract with Mobinil, France Telecom will pay 110 million Euro for it.

After this process, OTMT expects to offer administrative services for Mobinil as a local and strategic partner in its future operations.

Finally, OTMT expects that procedures to be finalized during October, November 2012.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) also witnessed no change at EGP 3.57.