Egypt c.bank releases inflation note for Dec ’24

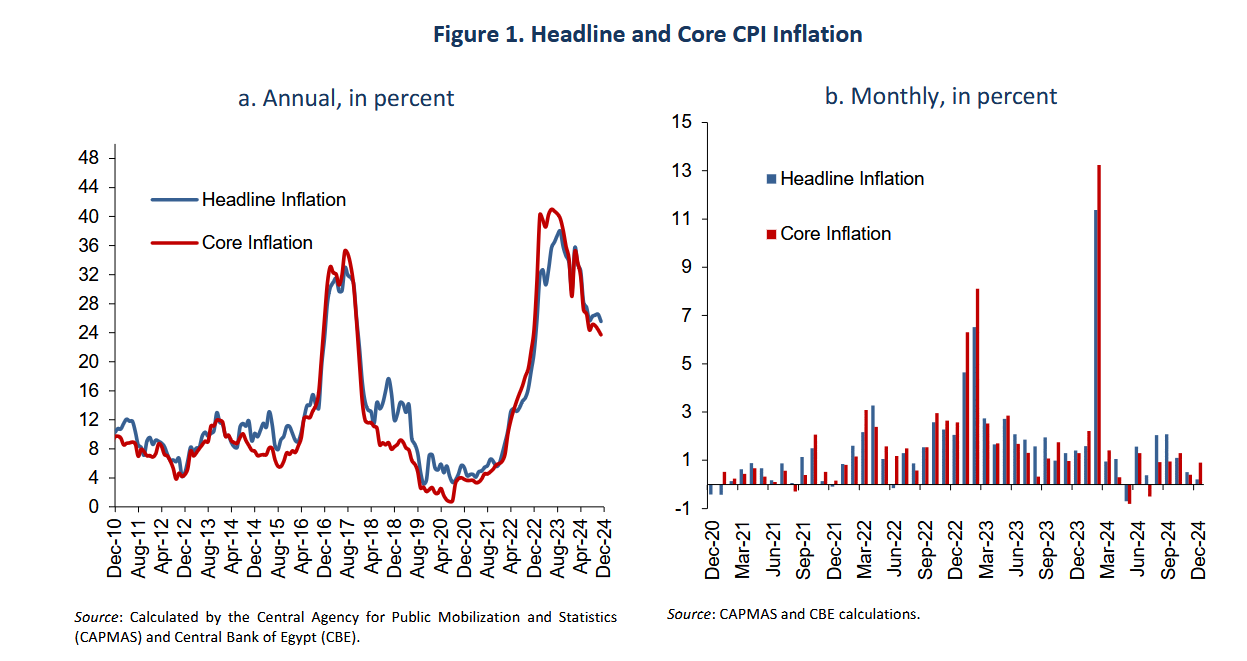

The Central Bank of Egypt (CBE) released on Thursday its Monthly Inflation Note for December 2024. According to the note, the annual urban headline inflation dropped to 24.1 percent in December 2024, compared to 25.5 percent in November 2024, marking its lowest level in two years. This decline was largely driven by a steady reduction in food inflation throughout 2024. Specifically, the significant decrease in fresh vegetable prices in December outweighed the rise in non-food inflation.

Annual core inflation remained relatively stable, reaching 23.2 percent in December 2024, slightly lower than 23.7 percent in November 2024. On a monthly basis, core inflation stood at 0.9 percent in December 2024, down from 1.3 percent in December 2023 but higher than 0.4 percent in November 2024. The monthly increase reflects moderate rises in retail and service prices, including expenditures on restaurants, cafes, and rents.

Monthly urban headline inflation was recorded at 0.2 percent in December 2024, a significant slowdown compared to 1.4 percent in December 2023 and 0.5 percent in November 2024. This reduction was attributed to a sharper-than-usual decline in fresh vegetable prices, which offset higher costs in non-food categories such as internet and mobile services, pharmaceutical products, and other items.

In rural areas, annual headline inflation fell to 22.8 percent in December 2024, down from 24.4 percent in November 2024. Nationwide, headline inflation also eased, declining to 23.4 percent in December 2024 from 25.0 percent in the previous month.

Factors Behind the Inflation Trends:

- Food Price Developments

The decline in inflation was driven primarily by a sharp decrease in fresh vegetable prices, which fell by 16.3 per cent. This decline was stronger than the usual seasonal trend and significantly contributed to the overall reduction in inflation. Prices for poultry and eggs also saw decreases of 0.1 per cent and 3.4 per cent, respectively. However, some core food items experienced moderate price increases. For example, the prices of oils and fats rose by 0.8 per cent, while dairy products increased by 0.6 per cent. - Non-Food Inflation

Non-food inflation experienced upward pressure due to rising costs in various sectors. The cost of services, such as mobile and internet services, rents, and expenditure on restaurants and cafes, increased noticeably. Additionally, retail prices also rose, with significant contributions coming from clothing, footwear, and personal care products. - Rural and Nationwide Trends

In rural areas, annual headline inflation decreased to 22.8 per cent in December 2024, down from 24.4 per cent in November 2024. Similarly, the nationwide headline inflation rate fell to 23.4 per cent, demonstrating consistent improvement across both urban and rural regions. - Core Inflation Stability

Annual core inflation remained broadly stable in December 2024, recorded at 23.2 per cent compared to 23.7 per cent in November 2024. On a monthly basis, core inflation registered an increase of 0.9 per cent, reflecting milder price increases in retail and service categories.

Contributing Economic Pressures:

Regulated items experienced a price increase of 0.8 per cent, which was mainly due to higher costs of pharmaceutical products and public transportation. Retail inflation and service inflation also contributed significantly to overall inflation. The rise in retail prices, particularly in clothing, footwear, and personal care products, contributed 0.23 percentage points to monthly headline inflation. Meanwhile, the rise in service-related costs added 0.42 percentage points to the monthly figure.

The decline in inflation, especially in urban areas, highlights the significant role of seasonal trends and policy measures in shaping the economic landscape. The reduction in fresh food prices has provided much-needed relief to consumers, although non-food and service-related expenses continue to exert upward pressure on inflation.

The CBE remains committed to closely monitoring these economic dynamics to ensure stable performance amid fluctuating global and local conditions.

Attribution: Amwal Al Ghad English