In a week, Egypt’s stock exchange attained gains totalling 6.6 billion pounds backed by the formation of a new military-backed government led by Eng. Ibrahim Mehleb. The country’s main stock index – EGX30 climbed 3% in a week to cross 8125 points, highest levels in five and a half years. Market experts and analysts expect EGX30 to target 8500 level in the short term.

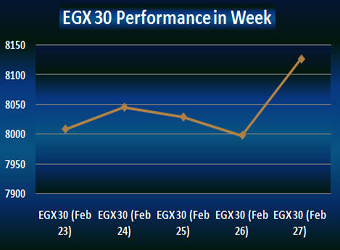

The Egyptian Exchange’s benchmark index EGX 30 index soared by 3% this week, registering a surge of 234.84 points, ending Thursday’s transactions at 8127.44 points compared to 7892.6 points at the end of a week earlier.

The main gauge index registered its highest point on Thursday closing at 8127.44 points, where its lowest point recorded on Wednesday at 7998.3 points.

Meanwhile, the mid- and small-cap index, the EGX70 inched down by 1.3% closing at 651.21 points during Thursday’s session, compared to 659.63 points at the end of a week earlier. The price index, EGX100 also fell by 0.73% concluding by 1119.09 points during Thursday’s session, against 1127.34 points at the end of a week earlier.

Furthermore, the market capitalization closed at EGP 491.847 billion last Thursday, compared to EGP 485.221 billion at the end of a week earlier.

Turnovers & Traded Volumes:

Through the week, the trading volume hit 1.4 billion securities, compared to 1.3 billion securities at the end of a week earlier. For the traded value, it reached EGP 6 billion against EGP 6.4 billion a week earlier.

Commenting on EGX30’s significant rally, Dr. Mohamed Omran – EGX Chairman – said on Tuesday capital market investors are buying shares based on their future expectations for economic conditions in Egypt in the medium and long terms.

In statements to MENA on Tuesday, Omran said EGX indices rise Monday reflected an upbeat sentiment among traders who believe that the future roadmap plan was going on the right track and the establishment of state foundations would be finalized soon by holding the presidential and parliamentary elections.

He said such upbeat trend would have a positive impact on the economy, noting that the volume of trading is much more important than indicators.