Significant improvement in Egyptian economy – CBE

Egypt’s external debt experienced a significant decline by the end of May 2024, dropping from $168.03 billion at the end of December 2023 to $153.86 billion by the end of May 2024, a senior Central Bank of Egypt (CBE) source told Amwal Al Ghad English on Monday. This represents a decline of $14.17 billion, or approximately 8.43 per cent.

The source said that, parallel with the decline in foreign debt, the net foreign reserves have hit an all time high of $46.38 billion by the end of June 2024, a $13.26 billion increase since August 2022. The current foreign reserves are sufficient to cover 7.9 months of merchandise imports, surpassing international safe levels.

He also said that foreign exchange inflows surged by 200 per cent, including 100 per cent increase in Egyptian expatriates’ remittances compared to pre-flotation levels.

The surge in foreign exchange inflows helped eliminate deficit of foreign assets held by the central bank to record $10.3 billion by June 2024, compared to (negative) $11.4 billion in January 2024, the source said.

He clarified that net foreign assets held by the banks experienced substantial growth, rising from (negative) $17.6b to $4.6b in May.

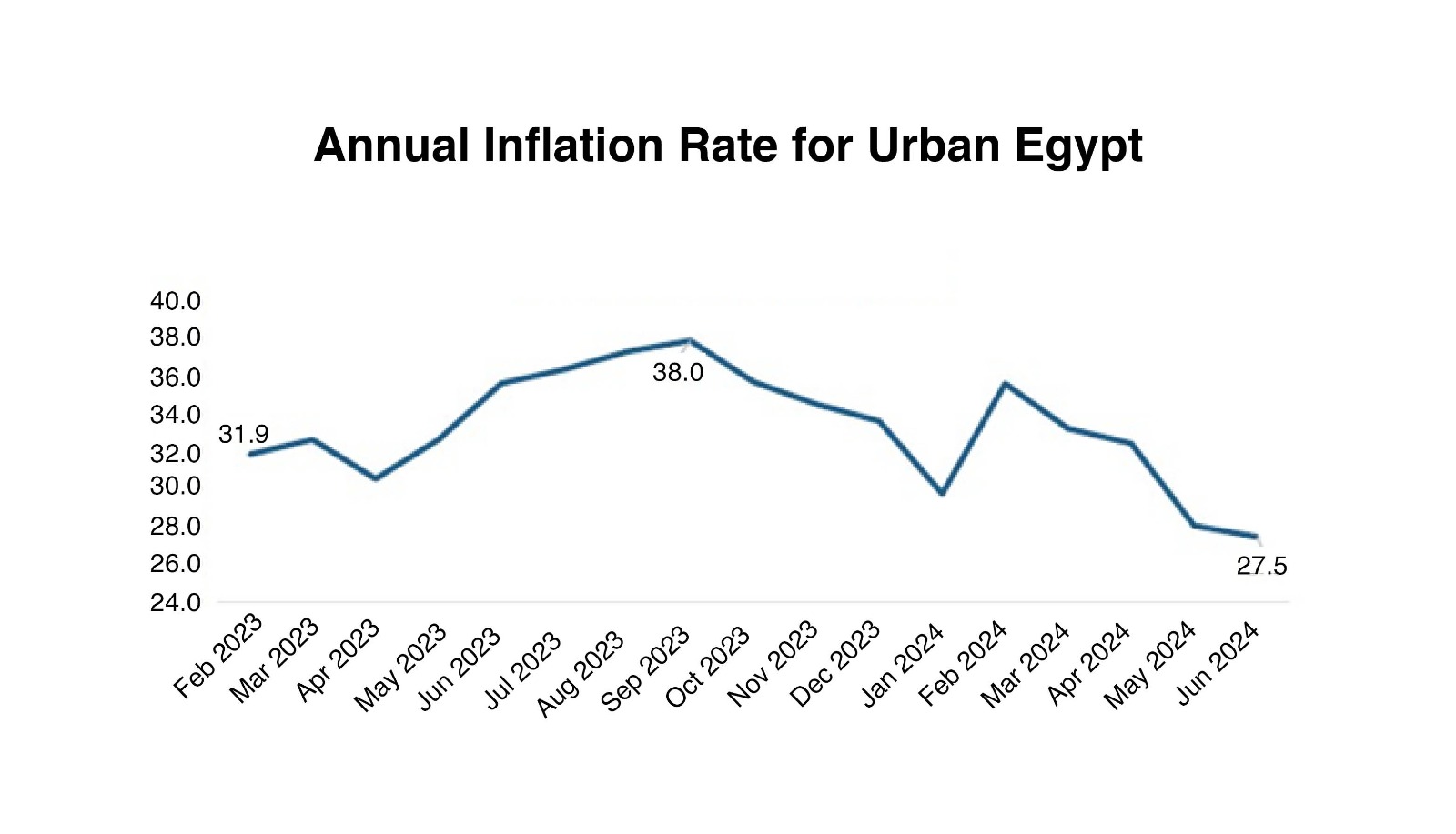

The high-ranking official said that Egypt’s daring monetary policy implemented since August 2022, have successfully tamed inflation levels which dropped to 27.5 per cent in June 2024, the lowest since February 2023. This drop means more stable prices, relief to households, and boosts confidence in the local currency and business environment, the official said.

Internationally, the source said, the yield on Egypt’s dollar-dominated bonds – maturing in January 2027 – have dropped dramatically, from 22.86 per cent in October 2023 to just 9.2 per cent in June 2024, about 13 per cent drop, that means lower borrowing costs and signals growing investor confidence in the country’s economic reform policies.

Egypt’s one-year credit default swap (CDS) contracts improved by 2,333 basis points between May 2023 and June 2024, reaching 346.3 basis points, indicating a decline in the risks of the Egyptian state’s debt instruments and an increase in confidence in the ability of the local economy to fulfil its international obligations. As a result, credit rating agencies have significantly upgraded their outlook on Egypt, revising their outlook for the economy, the official source concluded.

Attribution: Amwal Al Ghad English